The Common Transactive Services (CTS) is an application

profile of the OASIS Energy Interoperation 1.0 ([EI]) specification,

with most optionality and complexity stripped away. CTS defines the messages

for transactive energy, leaving communication details unspecified. Transactive

energy names the collaboration techniques to balance energy supply and energy

demand at every moment even as power generation becomes decentralized and as

the ownership of energy assets becomes more diverse.

The purpose of CTS is to enable broad semantic

interoperation between systems in transactive energy-based markets, or in any

markets whose products are commodities distinguished chiefly by time of

delivery. These time-volatile commodities are termed resources, and the

interactions defined in CTS are common to any market used to manage resources

over time.

To encourage broad adoption, CTS uses terms from financial

markets in preference to the relatively obscure terms used in specialized

energy markets. Among these is the use of the term instrument for a tradable

asset, or a negotiable item. In CTS, the term instrument encompasses a quantity

of a Resource delivered at a particular time for a particular duration. A

transaction is created when a buyer and seller agree on the price for an

instrument.

Transactive resource markets coordinate Resource supply and Resource

use through markets that trade instruments. The initial research into transactive

resource markets used a market to allocate heat from a single furnace within a

commercial building. Transactive resource markets balance supply and demand

over time using automated voluntary transactions between market participants.

Examples of transactable resources include, but are not

limited to, electrical energy, electrical power, natural gas, and thermal

energy such as steam, hot water, or chilled water. The capability to transmit

such time-dependent resources is also a transactable resource, as instruments

can be defined for transmission rights as well as for the services that

maintain grid frequency or voltage.

When we apply transactive resource markets to the

distribution of power or energy, we refer to it as transactive energy. A

significant driver of transactive energy is the desire to smooth supply and

demand variability, or alternatively, to match demand to variable supply. We

anticipate this variability to increase as additional variable and distributed

generation sources are connected to the power grid. The reader can find an

extended discussion of Transactive Energy (TE) in the EI specification [EI]

A goal of CTS is to enable systems and devices developed

today or in the future to address the challenges of increasing distributed

energy resources. CTS enables distributed actors to participate in markets

deployed today or in the future. The reader can find an extended discussion of

Transactive Energy (TE) in the [EI] specification.

CTS defines interactions between actors in energy markets. We

do not identify whether an Actor is a single integrated system, or a

distributed collection of systems and devices working together. See Section 1.5

for a discussion of the term Actor in this specification. Autonomous market

actors must be able to recognize patterns and make choices to best support

their own needs.

CTS messages are simple and strongly-typed, and make no

assumptions about the systems or technologies behind the actors. Rather, CTS

defines a technology-agnostic minimal set of messages to enable interoperation

through markets of participants irrespective of internal technology. In a

similar manner, CTS does not specify the internal organization of a market, but

rather a common set of messages that can be used to communicate with any

transactive energy market.

The Common Transactive Services, strictly speaking, are a

definition of the payloads and exchange patterns necessary for a full-service

environment for interaction with markets. In other words, CTS describes the

message payloads to be exchanged, defining the semantic content and ordering of

messages. Any message exchange mechanism may be used, including but not limited

to message queues and Service-Oriented mechanisms.

In a Service-Oriented Architecture [SOA] environment, the

semantic payloads are those sent and returned by the services described.

CTS enables any SOA or other framework to exchange equivalent semantic

information without presuming the specific messaging system(s) or architecture

used, thus allowing straightforward semantic interoperation.

See Section 2.2.

The purpose of this specification is to codify the common

interactions and messages required for energy markets. Any system able to use

CTS should be able to interoperate with any CTS-conforming market with minimal

or no change to system logic. The full protocol stack and cybersecurity

requirements for message exchange between systems using CTS are out of scope.

Systems that can be represented by CTS actors include but

are not limited to

·

Smart Buildings/Homes/Industrial Facilities

·

Building systems/devices

·

Business Enterprises

·

Electric Vehicles

·

Microgrids

·

Collections of IoT (Internet of Things) devices

TE demonstrations and deployments have seldom been

interoperable—each uses its own message model and its own market dynamics. Many

early implementations required transmitting information far beyond that needed

for transactions to remote or cloud-based decision aggregators termed markets. Such

markets discount local decision making while introducing new barriers to

resilience such as network failure. Others rely on a single price-setting

supplier. Systems built to participate in these demonstrations and deployments

have been unable to interoperate with other implementations. The intent of this

specification is to enable systems and markets developed for future deployments

to interoperate even as the software continues to evolve.

CTS does not presume a Market with a single seller (e.g., a

utility). CTS recognizes two parties to a transaction, and the role of any Party

can switch from buyer to seller from one transaction to the next. Each Resource

Offer (Tender) has a Side attribute (Buy or Sell). when each transaction is

committed (once the product has been purchased) it is owned by the purchaser,

and it can be re-sold as desired or needed.

A CTS-operated micromarket may balance power over time in a

traditional distribution system attached to a larger power grid or it may bind

to and operate a stand-alone autonomous microgrid [SmartGridBusiness].

Specific coding, message, and protocol recommendations are

beyond the scope of this specification which specifies information content and

interactions between systems. The Common Transactive Services payloads are

using the Universal Modelling Language [UML] and defined in XML schemas [XSD].

Many software development tools can accept artifacts in UML or in XSD to enforce

proper message formation. To further support message interoperability, two

additional common serializations are defined:

This specification provides [JSON] schemas compatible

with JSON Abstract Data Notation [JADN] format.

The FIX Simple Binary Encoding [SBE] specification is

used in financial markets. SBE is designed to encode and decode messages using

fewer CPU instructions than standard encodings and without forcing memory

management delays. SBE-based messaging is used when very high rates of message throughput

are required. This specification will deliver schemas for generating SBE

messages based on the common message content.

1.3 Naming Conventions

This specification follows some naming conventions for

artifacts defined by the specification, as follows:

For the names of elements and the names of attributes within

XSD files and UML models, the names follow the lowerCamelCase convention, with

all names starting with a lower-case letter. For example,

<element name="componentType" type="ei:ComponentType"/>

For the names of types within XSD files, the names follow

the UpperCamelCase convention with all names starting with an upper-case letter

prefixed by “type-“. For example,

<complexType name="ComponentServiceType">

For clarity in UML models the suffix “type” is not always

used.

For the names of intents and for attributes in the UML

models, names follow the lowerCamelCase convention, with all names starting

with a lower-case letter, EXCEPT for cases where the intent represents an established

acronym, in which case the entire name is in upper case.

JSON and where possible SBE names follow the same

conventions.

1.4

Editing Conventions

For readability, element names in tables appear as separate

words. The actual names are lowerCamelCase, as specified above, and as they

appear in the UML models, and in the XML and JSON schemas.

All elements in the tables not marked as “optional” are

mandatory.

Information in the Meaning column of the tables is

normative. Information appearing in the Notes column is explanatory and

non-normative.

Examples and Appendices are non-normative. In particular,

architectural and functional examples are presented only to support narrative

description. The specific processes, structures, and algorithms are out of

scope.

This specification defines message content and interaction

patterns.

The EI 1.0 specification in 2011, presumed web services for

interactions. That specification described a Service-Oriented Architecture

(SOA) approach. Service orientation complements loose integration and organizes

distributed capabilities that may be in different ownership domains by focusing

solely on requested results rather than on mechanisms. [EI] uses the language

of web services to describe all interactions.

There is a growing use of the descriptive term “cloud-native

computing” for extending the architecture and technologies developed for use in

clouds not only in data centers but to edge computing, where IoT devices

reside. A discussion of the rapidly-evolving topics of cloud-native computing

and edge computing is beyond the scope of this specification.

At the time of this specification, typical architectures

decompose applications into smaller, independent building blocks that are

easier to develop, deploy and maintain. A single market participant in energy may

be embodied as several of these independent blocks (actors). Message queues

provide loosely-coupled communication and coordination within and among these

distributed applications. Message queues enable asynchronous communication, i.e.,

the endpoints that are producing and consuming messages interact with the

queue, not each other. Publishers can add requests to the queue without waiting

for their processing. Subscribers process messages only when they are available.

In the Internet of Things (IoT), the term Actor is preferred

as the “actor model” makes no assumptions of the mechanisms or even motives

internal to an Actor. An Actor is simply a thing that acts. The Actor

implementation may be by a traditional computer, a cloud node, a human behind a

user interface, or any device in the Internet of things.

In transactive energy, we see the diversity supported by the

term Actor in the IoT. An energy seller may be a generator or a solar panel or

a virtual power plant or a demand responsive facility or a financial entity. An

energy buyer may be a home or commercial facility or an embedded device or a

microgrid or an energy district. A Marketplace acts to match Tenders, but may

also participate to buy or sell power for itself. An energy storage system may

act as a buyer or as a seller at any time.

Architectures MAY decompose applications into smaller

independent Actors. We use the term “Facet” to name a coherent se of

interactions that such an Actor may use to communicate with other Actors. An

Actor submits tenders to buy or to sell. An Actor may operate a Market. If the

architecture requires telemetry for Resource flow (metering), one of many

facets supported by a Resource-consuming Actor MAY provide it, or separate Actor

MAY present only the telemetry, logically and physically separated from the Resource-consuming

Actor. This specification makes no requirement as to how to distribute these

facets.

While this specification discusses messages between Actors,

it establishes no requirement or expectation of specific implementation. While

this specification uses the language of Actor and Facet, there is no

architectural expectation linked to this language. One could apply the terms

Actor and Facet throughout the [EI] specification. A traditional [EI]

application consisting of a several unitary systems each presenting all facets

as web services described by WSDL can be conformant so long as it uses a

compatible set of information payloads.

A discussion of the rapidly-evolving topic of cloud-native

computing is beyond the scope of this specification. This specification does

not require that implementations conform to any specific implementation of

cloud-native computing. Cloud-native and edge computing have informed the

language of this specification, just as web services and SOA informed [EI].

1.6 Security and Privacy

Service requests and responses are generally considered

public actions of each interoperating system, with limitations to address

privacy and security considerations (see Appendix B). Service actions are

independent from private actions behind the interface (i.e., device control

actions). A Facet is used without needing to know all the details of its

implementation. Consumers of services generally pay for results, not for

effort.

Size of transactions, costs of failure to perform,

confidentiality agreements, information stewardship, and even changing

regulatory requirements can require that similar transactions be expressed

within quite different security contexts. Loose integration using the

service-oriented architecture (SOA) style assumes careful definition of

security requirements between partners. It is a feature of the SOA approach

that security is composed in to meet the specific and evolving needs of

different markets and transactions. Security implementation is free to evolve

over time and to support different needs. The Common Transactive Services allow

for this composition, without prescribing any particular security

implementation.

The best practice in cloud-native computing is to use

Zero-Trust security [ZeroTrust]. Zero Trust security requires

authentication and authorization of every device, person, and application. The

best practice is to encrypt all messages, even those between the separate

components of an application within the cloud.

This specification makes no attempt to describe methods or

technologies to enable Zero Trust interactions between Actors.

Detailed knowledge of offers to buy or sell or knowledge of

energy inputs and outputs for an Actor may reveal information on actions and

operations. For example, transactions or tenders may indicate whether a production

line is starting or stopping, or anticipated energy needs, or who has been

buying or selling power. Making such information public may be damaging to

actors. Similarly, an adverse party may be able to determine the likelihood

that a dwelling is presently occupied.

The essence of any transaction is the agreement of a Party

to sell, and a Party to buy. The identity of the buyer and the identity of the

seller are each part of the transaction. Some transaction notifications may

hide the identity of the buyer from the seller. Some transaction notifications

may hide the identity of the seller from the buyer. Some transactions, such as

double auction, may be between the market participants as a whole, and not with

any particular counterparty. Where this is required, the Market itself may be

designated as the counterparty in a notification.

Both security and privacy considerations are addressed in Appendix B.

The semantics and interactions of CTS are selected from and

derived from [EI].

EI references two other standards, [EMIX] and [WS-Calendar],

and uses an earlier Streams definition. We adapt, update, and simplify the use

of the referenced standards, while maintaining conformance.

•

EMIX describes price and product for electricity markets.

•

WS-Calendar communicates schedules and sequences of operations. CTS uses

the [Streams] optimization which is a standalone specification, rather than

part of EI 1.0.

•

EI uses the vocabulary and information models defined by those

specifications to describe the services that it provides. The payload for each

EI service references a product defined using [EMIX]. EMIX schedules and

sequences are defined using [WS-Calendar]. Any additional schedule-related

information required by [EI] is expressed using [WS-Calendar].

•

Since [EI] was published, a semantically equivalent but simpler

[Streams] specification was developed in the OASIS WS-Calendar Technical

Committee. CTS uses that simpler [Streams] specification.

All terms used in this specification are as defined in their

respective specifications.

In [EI], the fundamental resource definition was the [EMIX]

Item, composed of: a resource name, a unit of measure, a scale factor, and a

quantity. For example, a specific EMIX item may define a Market denominated in

25 MW-hour bids. [EI] defined how to buy and sell items during specific

intervals defined by a duration and a start time. The Quotes, Tenders, and

Transactions that are the subject of [EI] added specific prices and quantities

to the item and interval. EMIX optionally included a location, i.e., a point of

delivery for each [EI] service.

In CTS, we group and name these elements as a Resource, Product,

and Instrument. These terms are defined in Section 2.1.3, “Resources,

Products, and Instruments”

Note that the informational elements in a fully defined

tender or transaction are identical to those described in EMIX. The conceptual regrouping

enables common behaviors including Market discovery and interoperation between Actors

built on different code bases.

EI defines an end-to-end interaction model for transactive

services and for demand response. CTS uses the EI transactive services, and

draws definitions of parties and transactive interactions primarily from the

[EI] TEMIX profile.

This specification can be viewed as a minimal transactive

profile of [EI]

This specification uses a simplified profile of the models

and artifacts defined in OASIS Energy Market Information Exchange [EMIX]

to communicate Product definitions, quantities, and prices. EMIX provides a

succinct way to indicate how prices, quantities, or both vary over time.

The EMIX Product definition is the Transactive Resource in

CTS 1.0.

EMIX also defines Market Context, a URI used as the

identifier of the Market. EMIX further defines Standard Terms as retrievable

information about the Marketplace that an actor can use to configure itself for

interoperation with a given Marketplace. We extend and clarify those terms,

provide an extension mechanism, and discuss the relationship of markets, Marketplaces,

and products.

WS-Calendar expresses events and sequences to support

machine-to-machine (M2M) negotiation of schedules while being semantically

compatible with human schedules as standardized in [iCalendar]. Schemas

in [WS-Calendar] support messages that are nearly identical to those

used in human schedules. We use a conformant but simpler and more abstract

Platform Independent Model [CAL-PIM] and the [Streams] compact

expression,

to support telemetry (Delivery Facet) and series of Tenders while not extending

the semantics of [Streams].

By design and intent, the [WS-Calendar] schemas

provide the capability of mapping between human and M2M schedules.

WS-Calendar conveys domain specific information in a

per-event payload. An essential concept of WS-Calendar is inheritance, by which

a starting time can be applied to an existing message, or by which all events

in a sequence share common information such as duration. Inheritance is used to

“complete” a partial message during negotiation. CTS makes use of this to apply

a common market Product across a sequence, or to convey a specific starting

time to a market Product.

CTS messages conform to [Streams] format. See also

Section 3.1.

The Facilities Smart Grid Information Model [FSGIM]

was developed to define the power capabilities and requirements of building

systems over time. FSGIM addresses the so-called built environment and

uses the semantics of WS-Calendar and EMIX to construct its information models

for power or other Resource use over time. These sequences of [power]

requirements are referred to as load curves. Load curves can potentially be

relocated in time, perhaps delaying or accelerating the start time to get a

more advantageous price for [power].

Because FSGIM load curves use the information models of EMIX

and WS-Calendar, conforming load curves submitted by a facility could be the

basis upon which a TE Agent would base its market decisions.

The Architecture of CTS is premised on distinct physical

systems being able to interoperate by coordinating their production and

consumption of energy irrespective of their ownership, motivations, or

internal mechanisms. This specification defines messages and interactions of

that interoperation.

FSGIM load requests can be expressed using CTS tenders. CTS

1.0 uses single-interval [Streams] to express single-interval tenders in

anticipation of possible future use of Streams in FSGIM-conformant

communications.

2.1 Scope of Common Transactive Services

CTS provides for the exchange of resources among parties

which represent any provider or consumer of energy (e.g., a distributed energy

resource). CTS makes no assumptions as to their internal processes or

technology.

This specification supports agreements and transactional

obligations, while offering flexibility of implementation to support specific

approaches and goals of the various participants.

No particular agreements are endorsed, proposed or required

in order to implement this specification. Energy market operations are beyond

the scope of this specification although interactions that enable management of

the actual delivery and acceptance are within scope but not included in CTS

1.0.

As shown in [CTS2016] the Common Transactive Services with suitable

Product definitions can be used to communicate with essentially any market.

As an extended example, using the Common Transactive

Services terminology, a microgrid is comprised of interacting nodes each

represented by an actor (interacting as CTS parties). Those actors interact in

a micromarket co-extensive in scope with the microgrid. No actor reveals any

internal mechanisms, but only its interest in buying and selling power.

An actor can represent a microgrid within a larger

micromarket; the actor would in effect aggregate the resources in the

microgrid. As above, such an actor would not reveal any internal mechanisms,

but only its interest in buying and selling power. There is no explicit bound

on repeating this interoperation pattern.

An actor representing a microgrid may interoperate with

markets in a regional grid, which may or may not be using CTS. The regional

grid may use transactive energy expressed in non-CTS messages, or

infrastructure capacity may limit delivery to the microgrid. In either case,

the An actor representing a microgrid must translate and enforce constraints and

share information with the other nodes in the microgrid solely by means of CTS.

Any translations or calculations performed are out of scope.

See informative references [StructuredEnergy] and [SmartGridBusiness]

for a discussion. [Fractal Microgrids] is an early reference that

describes hierarchies of microgrids. [Transactive Microgrids] describes

transactive energy in microgrids.

Interaction patterns and facet definitions to support the

following are in scope for Common Transactive Services:

- Interaction

patterns to support transactive energy, including tenders, transactions,

and supporting information

- Information

models for price and Product communication

- Information

models for Marketplace and Market characteristics

- Payload

definitions for Common Transactive Services

The following are out of scope for Common Transactive

Services:

- Requirements

specifying the type of agreement, contract, Product definition, or tariff

used by a particular market.

- Computations or

agreements that describe how power is sold into or sold out of a Marketplace.

- Communication

protocols, although semantic interaction patterns are in scope.

This specification describes standard messages, the set of

which may be extended.

Systems use the common transactive services to operate

transactive resource markets. A transactive resource market balances the supply

of a resource over time and the demand for that resource by using a market

specifying the time of delivery.

In [EI], the fundamental resource definition was the [EMIX]

Item, composed of: a resource name, a unit of measure, a scale factor, and a

quantity. For example, a specific EMIX item may define a Market denominated in

25 MW-hour bids. [EI] defined how to buy and sell items during specific

intervals defined by a duration and a start time. The Quotes, Tenders, and

Transactions that are the subject of [EI] added specific prices and quantities

to the item and interval. EMIX optionally included a location, i.e., a point of

delivery for each [EI] service.

In CTS, we group and name these elements as a Resource, Product,

and Instrument. A Resource is the name and the unit of measure, as in the EMIX

Item. A Product, i.e., what can be bought and sold in a Market, in addition

specifies “how much” and “for how long” as well as optional elements such as

location and Warrants. The term Instrument, as in financial markets, adds a

specific start time to a Product.

We define a Resource as any commodity whose value is

determined by a fine-grained time of delivery. Transactable resources include,

but are not limited to, energy, heat, natural gas, water, and transport as a

support service for these. The ancillary services reactive power, voltage

control, and frequency control are also transactable.

A Product names a transactive Resource that has been

“chunked” for Market. These chunks define the Market’s granularity in quantity

and in time. For example, the Product may be 1 MW of power delivered over an

hour. Similarly, another Product may be 1 kW of power over a 5-minute period.

Some transactive energy markets in North America today have durations as brief

as two seconds. Temporal granularity is equally important as quantity for Product

definition.

An Instrument is a Product at a specific time, following

common usage in financial markets where an instrument names the thing that is

bought or sold. For example, the 1 MW of Power delivered over an hour beginning

at 3:00 PM is a different Instrument than the same Product delivered starting

at 11:00 PM.

A Market considers all the tenders it has received offering

to buy or sell an Instrument, using a Matching Engine to decide which can be

cleared (satisfied) in full or in part. The 3:00pm Instrument is traded

independently from the 4:00pm Instrument. This specification does not assume or

require an Order Book, a Double Auction, or any other mechanism in the Matching

Engine.

The Resource definition is extensible using standard UML

techniques (subclassing); however CTS 1.0 uses only this base definition.

These terms are summarized in Table 2‑1: .

Table 2‑1:

Definitions of CTS Market terms

|

Transactive Entity

|

Definition

|

|

Resource

|

A measurable commodity, substance, service, or force,

whose value is determined by time of delivery.

|

|

Product

|

A Resource defined by size/granularity of the Resource

and by the granularity of time. A Market is defined by its Product. Example

1: electric power in 10 kW units delivered over an hour of time. Example 2:

electric energy in 1 kWh units delivered over a quarter hour.

|

|

Instrument

|

A Product instantiated by a particular begin time.

Example: the Product beginning at 9:00 AM on April 3. An Instrument is

Tendered to a Market with specific quantity and price.

|

|

Party

|

An Actor or a set of coordinating Actors that buys or

sells Instruments in a CTS Marketplace. A Party may be described by a

specific role in a specific interaction, such as Party or Counter Party. For

semantic and privacy issues, see Section 2.2.3 below.

|

|

Market

|

A Facet where Parties trade a Product using tenders

submitted to buy or sell an Instrument.

|

|

Marketplace

|

A Marketplace names a set of Markets accessible to a

Party. The Marketplace Facet supplies limited information common to all

Markets in the Marketplace. The Facet also enumerates all Resources and

Products available in the Marketplace, as well as a directory of the Markets

for each Resource.

CTS differs from EMIX in adding a distinction between

Market and Marketplace, while making no assumption about how the distinction

is implimented or even whether Markets and Marketplaces share common

ownership. The [EMIX] Market Context, identified by a URI, is akin to the CTS

Marketplace.

|

|

Market Context

|

A URI identifying an individual Market, as defined in

EMIX.

|

|

Marketplace Context

|

A URI identifying a Marketplace, as defined in the

EMIX Market Context.

|

|

Matching Engine

|

There are many Market processes to exchange offers and

reach agreements on transactions. Different parts of the same Marketplace MAY

employ different Market processes. We term each of these processes a Matching

Engine. This specification uses the term Matching

Engine only to support narrative description. The specific processes,

structures, and algorithms of Matching Engines are out of scope.

|

2.2 Common Transactive Services Roles

Actors interact through Facets. The specification makes no

assertions about the behaviors, processes, or motives within each Actor. A

particular Actor may use all Facets, a subset of Facets, or even a single

Facet. This specification defines Facet messages and interactions.

[EI] defines contracts between Actors as services

with defined messages and interactions. All [EI] services map to CTS

Facets. Nearly all Facets defined in CTS are services as defined in [EI].

CTS defines two additional Facets for market operations not derived from the

Services in [EI], namely Position and Delivery, as well as two facets for Market

discovery, the Marketplace and Market Facets. CTS does not require a conforming

transactive energy market to use every Facet.

The Common Transactive Services (CTS) defines interactions

in a Resource Market. This Resource Market is a means to make collaborative

decisions that allocate power or other Resource over time. We follow [EI] and

financial markets by terming market participants as Parties.

A Party can take one of two Sides in Transaction:

·

Buy, or

·

Sell

A Party selling an Instrument takes the Sell Side of the

Transaction. A Party buying [an Instrument] takes the Buy Side of the

Transaction. The offering Party is called the Party in a Transaction; the other

Party is called the Counterparty

From the perspective of the Market, there is no distinction

between a Party selling additional power and Party selling from its previously

acquired position. An Actor representing a generator would generally take the

Sell side of a transaction. An Actor representing a consumer generally takes

the Buy side of a transaction. However, a generator may take the Buy Side of a

Transaction to reduce its own generation, in response either to changes in

physical or market conditions or to reflect other commitments made by the

actor. A consumer may choose to sell from its current position if its plans

change, or if it receives an attractive price. A power storage system actor may

choose to buy or sell from Interval to Interval, consistent with its operating

and financial goals.

A Party may represent a single actor, or the roles (see

Facets, below) of a single Party may distributed across multiple Actors.

We do not specify how to manage delivery of the Resource.

This specification refers to coherent

se of interactions, that is, closely related requests, responses, as Facets. A

Facet sends and receives defined messages to interact with other Actors that

expose the same Facet. An Actor in a CTS-based system of systems may expose all

Facets, a single Facet, or any collection of Facets. A particular Market may

use some or all named Facets. A participant in a Market must include Actors

supporting each Facet required in that Market; there is no requirement that

each Actor supports all these Facets.

Each Facet named below groups a

mandatory set of related messages and interactions. Detailed descriptions of

each facet begin in Section 6.

Table 2‑2: Facets Defined in CTS

|

Facet

|

Definition

|

|

Marketplace

|

The Marketplace Facet exchanges information about the

Marketplace and its Products and Markets. A Party registers with a

Marketplace through this Facet. A Party may query the Marketplace to discover

the Resources and Products traded in a Marketplace. When a Marketplace

includes multiple Products, the Party needs to know where to find the Market

for each Product. While a Marketplace may change slowly over time, the

Marketplace facet can generally be viewed AS conveying static information.

|

|

Market

|

A Market Facet exchanges information for trading a

particular Product in a particular Market. Parties submit Tenders to a

Market, and the Market notifies the Parties of Transactions. A Market Facet

contains a Matching Engine that matches Tenders to buy and Tenders to sell. The

Market Facet conveys information as to how the Market matches orders, which

may change the strategies used by a Market participant. Some Markets MAY

register transactions privately agreed to among Parties.

See Section 8 Market Facet

|

|

Registration

|

A Party must Register with a Marketplace to

participate in the Markets in that Marketplace.

See Section 6, Party Registration Facet.

|

|

Tender

|

Tenders are actionable offers to buy or to sell an Instrument

at a given price. Tenders go to the Market and are generally private. It is

possible to request that a Tender be advertised to all Parties in the Market.

Note: a Tender for one side MAY match more than one Tender on the other side,

which could generate multiple Transactions.

See Section 9, Tender Facet.

|

|

Transaction

|

A Transaction records a contract when a Tender to buy

and a Tender to sell are matched. Each Party is notified of the creation of

the Transaction. Note: a Tender for one side MAY match more than one Tender

on the other side, which would generate multiple Transactions.

See Section 10, Transaction Facet.

|

|

Position

|

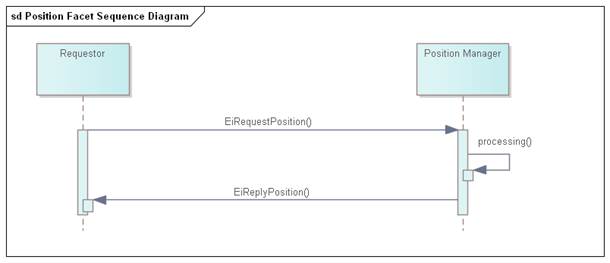

At any moment, a Party has a position which represents

the cumulative amount of an Instrument that an actor has previously

transacted for within a bounding time interval. A Position for an Instrument

reflects the algebraic sum of all quantities previously bought or sold.

See Section 11, Position Facet.

|

|

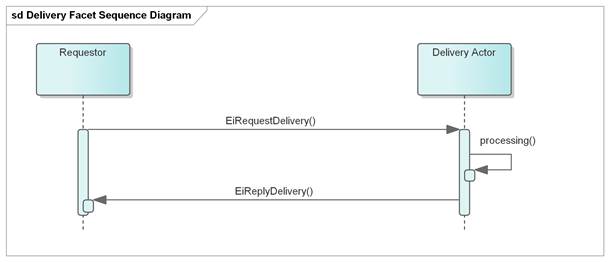

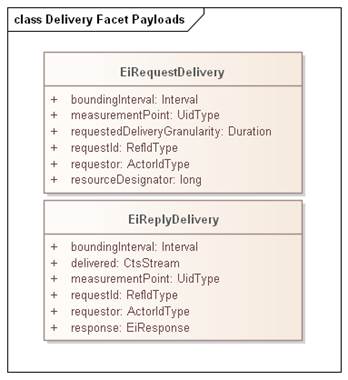

Delivery

|

It is simplest to think of Delivery as a meter

reading, although that meter may be virtual or computed. Some implementations

may compare what was purchased or sold with what was delivered. What a system

does after this comparison is out of scope.

See Section 12, Delivery Facet.

|

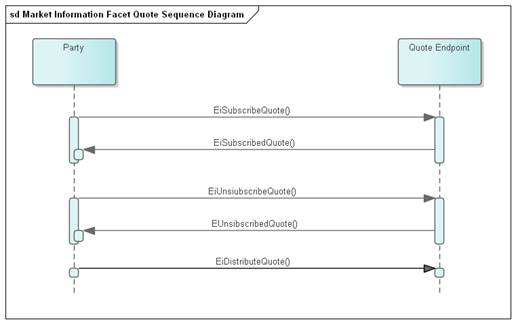

|

Quote

|

A Quote is a non-actionable indication of a potential

price or availability of an Instrument. [EI] defines the EiQuote

service. This specification extends the Quote to include forecasts, information

about completed Transactions, and other Market information.

See Section 13 Market Information—the Quote and Ticker

Facets

|

|

Ticker

|

Named for the stock ticker, best known for its printed

output the ticker tape. A ticker provides public information about transactions

over time.

See Section 13 Market Information—the Quote and Ticker

Facets

|

Each of these facets includes multiple messages which are

described starting in Section 4. Sometimes one facet precedes the use of

another facet, as Tenders may initiate messages for the Transaction Facet.

2.2.3 Party and Counterparty

in Tenders and Transactions

The Party in a Tender is offering to buy or sell. The PartyID

in a Tender should always reference the Party that is tendering.

When the Market recognizes Tenders that match each other,

however defined, the Market generates a Transaction that represents a contract

between the buyer and the seller. This Transaction includes a Party and a

Counterparty.

See Section 13, “Market Information—the Quote and Ticker

Facets” for a discussion of Market Information.

This section re-iterates terms and simplifies models from

[EI]. That specification is normative. The form of the Response is common

across all Facets.

Table 2‑3:

Responses

|

Attribute

|

Meaning

|

|

Request ID

|

A reference ID which identifies the artifact or

message element to which this is a response. The Request ID uniquely

identifies this request and can serve as a messaging correlation ID[5].

|

|

Response Code

|

The Response Code indicates success or failure of the

operation requested. The Response Description is unconstrained text, perhaps

for use in a user interface.

The code ranges are those used for HTTP response

codes,[6]

specifically

1xx: Informational - Request received, continuing

process

2xx: Success - The action was successfully received,

understood, and accepted

3xx: Pending - Further action must be taken in order

to complete the request

4xx: Requester Error - The request contains bad syntax

or cannot be fulfilled

5xx: Responder Error - The responder failed to fulfill

an apparently valid request

|

The Most operations have a response.

The messages of CTS use a few common elements. These

elements are derived from and compatible with definitions in [WS-Calendar],

[EMIX], and in [EI].

Time and Duration are the essential elements of defining an Instrument

as well as for interacting with a Market. A Stream [Streams] is a series

of back-to-back intervals each with its own associated information. Section 5 defines the CTS Stream as a conformant specialization of [Streams],

integrating information that is outside of a Stream data structure but

associated with a Stream.

Table 3‑1: CTS Elements from WS-Calendar

|

Attribute

|

Meaning

|

|

Duration

|

Duration is used to define

Products, as in “Power can be purchased and there is a one-hour (duration)

market for Power”.

Duration is also used in

Delivery to specify the period over which Delivery is measured, as in “How

much Power was delivered in the 4 hours beginning with the Begin Date-Time?”

|

|

Offset

|

An offset (expressed as a

WS-Calendar Duration) that some markets MAY use to transfer trading away from

hourly boundaries.

A power distribution entity

may experience disruption if there is a big price change on the hour. Offset

enables a Market to trade, for example, 3 minutes after the hour. See also

Market Facet

|

|

Begin Date-Time

|

Begin Date-Time fully binds

a Duration into an Interval. When applied to a Product, the Begin Date-Time

defines an Instrument., i.e., something that is directly traded in the

Market.

|

|

Expiration Date-Time

|

Expiration is used to limit

the time a Tender is on the Market. There is an implicit expiration for every

Tender equal to the Begin Date-Time of the Instrument. Expiration Date-Time

is needed only if the requested Expiration is prior to the Begin Date-Time of

the Instrument.

|

|

Interval

|

An Interval in CTS is a

Duration with a Begin Date-Time. This maps to what WS-Calendar names a

“Scheduled Interval”.

|

EMIX defines the specification of commodity goods and

services whose value is determined by time and location of delivery. EMIX

defines an “Item” by what is sold in a Market, when it is sold, what the units

are, and what the standard trade size is. EMIX further defines how to communicate

the date and time of delivery for that commodity to define a unique Product

that can be bought and sold in a Market.

In CTS, we maintain the semantics of EMIX while giving name

to each refinement of the information. These names are the Resource (what is

sold), the Product (how the Resource is packaged into a size and Duration for

sale), and the Instrument (a Product sold at a specific time). Instruments are

what are bought and sold in CTS markets.

Here we define a Resource as a commodity that is bought or

sold in a CTS Marketplace. A Party can query a Marketplace to discover the

Resources that can traded in each of the Markets in the Marketplace.

Table

3‑2: Defining the Resource

|

Attribute

|

Meaning

|

|

Resource

|

A

Resource consists of a Resource Designator, a Resource Name and a Resource

[Item] Description.

|

|

Item

Description

|

The

Item Description is a common name, as defined in EMIX

|

|

Item

Unit

|

Item

Unit is the unit of measure for the Resource.

|

|

Attributes

|

Optional

elements that further describe the Resource, as in hertz and voltage

|

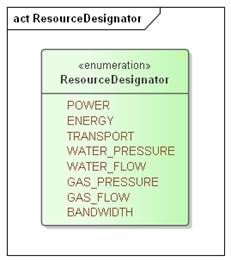

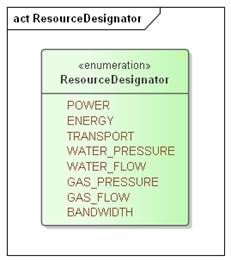

A Resource Designator is an extensible enumeration. The

standard enumeration is defined in Figure 3‑1 Resource Designator

Extensible Enumeration:

j

j

Figure 3‑1 Resource Designator Extensible Enumeration

The Product is a Resource packaged for Market. The size and

duration of the Resource define what is, in effect, the “package size” for the

commodity. A Marketplace may offer multiple Products for the same Resource.

Table

3‑3: Defining the Product

|

Attribute

|

Meaning

|

|

Product

|

Abstract Base for all defining all Products. The core

of each Product is the Resource, as referenced by the Resource Designator.

|

|

Scale

|

Exponent that specifies the size of the Resource Unit.

For example, a Product denominated in Megawatts has a Scale of 6.

|

|

Size

|

An integer “chunking” the Product, i.e., the Product

could be traded in units of 5 kW, a size of 5 and a scale of 3.

|

|

Warrant

|

Undefined element of a Product that restricts the Product

beyond the Resource definition. For example, it is possible to trade in power

designated to be Neighborhood Solar Power. In CTS, Products that are

identical other than the Warrant are traded in different Markets within the

same Marketplace.

|

Products with differing Warrants are different Products and

therefore traded in different Markets.

As non-normative examples, if an Actor wishes to buy energy

with a Green Warrant (however defined) then the Actor, not the Market,

is responsible for defining its trading strategies if the warranted Product is

not available. Similarly, an Actor that wishes to buy or sell Neighborhood

Solar Power is responsible for submitting Tenders that expire in time to make

alternate arrangements, or in time to cancel Tenders before fulfillment. This

specification establishes no expectation that the Market engine address these

issues automatically.

Warrants are defined in [EMIX], and are permitted in

CTS to support this complexity if desired, but not described in this

specification.

EMIX defines vocabulary used in market messages and

interactions.

Table

3‑4: Market-related elements from EMIX

|

Attribute

|

Meaning

|

|

PartyID

|

The Marketplace-based ID of an actor participating in

Markets, particularly the actor originating a Tender, Quote, or Contract.

|

|

Counter PartyID

|

The Marketplace-based ID of an actor participating in

Markets, particularly the actor taking the other side of a contract from the

Party. See Section 2.2.3.

|

|

Side

|

An indication of what a Party offers in a Tender or

other message, i.e., “Buy” or “Sell”.

|

|

Expiration Date-Time

|

Expiration is used to limit the time a Tender is on

the Market. There is an implicit expiration for every Tender equal to the

Begin Date-Time of the Instrument. Expiration Date-Time is needed only if the

requested Expiration is prior or subsequent to the Begin Date-Time of the

Instrument.

|

|

Market Context

|

In EMIX, the Market Context is simply a URI to name a Market,

and need not be resolvable. CTS distinguishes between a Marketplace, where

many Products may be sold and the Market, where a specific Product is sold.

See Section 6. “Marketplace Facet”.

|

|

Standard Terms

|

Standard Terms are the machine-readable information

about a Marketplace or Market, and the interactions it supports. In CTS, the

Standard Terms include an enumeration of the Products and their respective

Markets tradable in this Marketplace. See Section 6, “Market Facet”.

|

EMIX does not define how an Actor

discovers the Standard Terms in a Marketplace. CTS defines the Marketplace

Facet and the Market Facet to discover and expose Products and Standard Terms.

The Common Transactive Services presented in this

specification are described in the following sections, and are

- Marketplace

Facet—characteristics and to know what Products and Instruments can be

traded

- Party

Registration Facet—identification of actors within a Market or Marketplace

- Tender

Facet—make offers to buy and sell Instruments

- Transaction

Facet—for expressing transactions.

- Position

Facet—Describe what has been previously bought or sold

- Delivery

Facet—Request data on actual deliveries

- Market

Information—the Quote and Ticker Facets

We include UML definitions for the standard payloads for

service requests, rather than the service, communication, or other

characteristics. In Section 14 we describe standard serialization for the CTS

standard payloads; additional bindings may be used by conforming

implementations.

Transactive Services in EI define and support the lifecycle

of transactions from preparation (registration) to initial Tender to final

settlement. The phases described in EI are in the following table with the CTS

Facets in Column 2.

Table 4‑1:

Mapping CTS Facets to EI Phases

|

EI

Phase

|

CTS

Facet(s)

|

|

Registration (and Market discovery)

|

Party Registration Facet

Marketplace Facet

Market Facet

|

|

Pre-Transaction

|

Quote Facet

Tender Facet

|

|

Transaction

|

Transaction Facet

|

|

Post-Transaction

|

Position Facet

Delivery Facet

Ticker Facet

|

4.2

Naming of Services and Operations

The naming of services and operations and service operation

payloads follows the pattern defined in [EI]. Services are named starting with

the letters Ei following the Upper Camel Case convention.

Operations in each service use one or more of the following patterns. The first

listed is a fragment of the name of the initial service operation; the second

is a fragment of the name of the response message which acknowledges receipt,

describes errors, and may pass information back to the invoker of the first

operation.

Create—Created An

object is created and sent to the other Party

Cancel—Canceled

A previously created request is canceled

For example, to construct an operation name for the Tender

facet, "Ei" is concatenated with the name fragment (verb) as listed.

An operation to cancel an outstanding Tender is called EiCancelTender.

Facets describe what would be called services in a

full Service-Oriented Architecture implementation, as we do not define SOA

services, but only imply and follow a service structure from [EI].

4.3 Payloads and Messages

We define only the payloads; the particular networking

technique and message structure is determined by the applications sending and

receiving CTS payloads.

While the payloads are logically complete with respect to

the SOA interactions in [EI], the payloads may be exchanged by any means; such

exchanges are below the semantic level of this specification.

4.4 Description of the

Facets and Payloads

The sections below provide the following for each service:

- Facet

description

- Table of

Payloads

- Interaction

patterns for payload exchange in graphic form, using EI normative

interactions and UML Sequence Diagrams [UML].

- Normative

information model using [UML] for key artifacts used by the facet

- Normative operation

payloads using [UML] for each interaction

Responses may need to be tracked to determine whether an

operation succeeds or not. This may be complicated by the fact that any given Transaction

may involve the transmission of one or more information objects.

An EiResponse returns the success or failure of the entire

operation, with possible detail included in responseTermsViolated (see Section 5).

It is MANDATORY to return responses

indicating partial or complete success or failure.

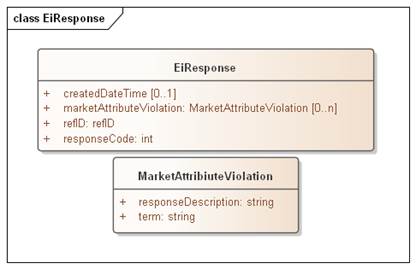

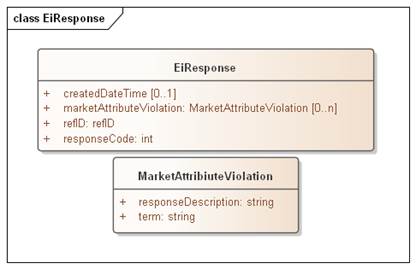

The class diagram in Figure 4‑1 shows the generic CTS

response.

CTS uses a simplified version of EiResponseType from EI, deleting

ArrayOfResponseTermsViolated and responseDescription (to zero, that is, not

passed). Response Terms Violated is renamed Market Attribute Violation.

Figure 4‑1: Example of generic response object

There is no exhaustive list of all possible Response Codes.

More detail on Response Codes is in Section 2.3.

The Response Codes are intended to enable even the smallest

device to interpret Response. This specification uses a pattern consisting of a

3-digit code, with the most significant digit sufficient to interpret success

or failure. This pattern is intended to support that smallest device, while

still supporting more nuanced messages that may be developed.

The only defined value in EI after the leading digit of the

Response Code is 00. Conforming specifications may extend these codes to define

more fine-grained response codes. These should extend the pattern above; for

example, a response code of 403 should always indicate Requester Error.

Response codes not of the form x00 MAY be treated as the parallel x00 response.

As an example, consider a request to quote 13.5 kW at three

minutes offset for 17 minutes where the market characteristics and its product

include 10kW granularity, zero offset, and five minute duration. The terms in

the Market Attribute Violation therefore include at least these violations:

·

T_GRAIN, 5m

·

Q_GRAIN, 10kW

·

OFFSET, 0

The definition of the respective terms is in Section 8, Market Facet.

Aside from registration and market information, Payloads in

CTS are derived from and conformant with WS-Calendar Streams. The essence of

Streams is that for a series of consecutive Durations over time, called

Intervals, invariant information is in the header or preface to the stream, and

only the varying information is expressed in each Interval.

For CTS, this means that a Product is fully described in the

header, and only the elements that vary, such as the Price or the Quantity, are

expressed in the intervals.

CTS Streams use this same format even when the Intervals

contain only a single Interval.

In addition, CTS Streams include energy-market elements that

are outside the Streams standard but follow the pattern of referrals as defined

in [Steams] conformance.

CTS Streams have neither interaction patterns nor payloads,

as they are a common abstract information model used to define the messages used

in Facet messages.

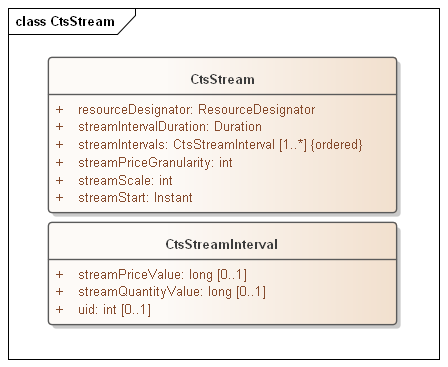

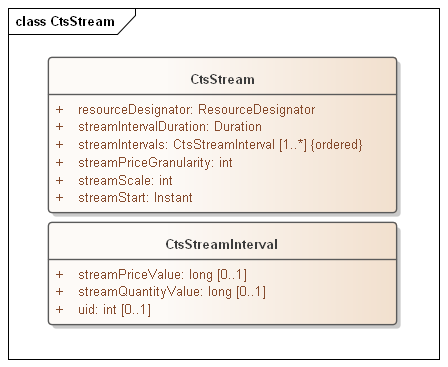

The CTS Stream is defined as follows. The elements from [Streams]

have been flattened into the CTS Stream, and the Stream Interval and payload

flattened into a streamPayloadValue and the internal local UID for the stream

element.

Figure 5‑1:

CTS Stream Definition

As with [Streams], CTS Stream Intervals are ordered, that is

the sequence of intervals is essential. Some serialization specifications,

notably XML, do not require that order be preserved when deserializing a list.

The UID enables proper ordering of the Stream Intervals if order is not

preserved. Since conformant CTS implementations need not be owned by the same

implementer, and may pass through multiple translations, the UID property is

required.

The following tables describe the attributes for CTS Streams

and Stream Intervals.

Table

5‑1: CTS Stream Attributes

|

Attribute

|

Meaning

|

Notes

|

|

Resource Designator

|

An item from an enumeration that indicates the

Resource for the Product and Market

|

The Resource Designator in a Market should match the Resource

Designator indicated in the Marketplace

|

|

Stream Scale

|

The Scale is the exponent that determines the size of

the Resource.

|

For example, if Scale is 3 and the Resource is Watts,

then the value is in kW. If the Scale is 6, then the value is in MW.

|

|

Stream Interval Duration

|

The duration for each of the contiguous Stream

Intervals

|

This completes the Product definition of a Resource

at a Scale and Size delivered over a Duration.

|

|

Stream Price Granularity

|

Price granularity expressed as an exponent. Applies

to all Intervals in the Stream. Not required for all Facets.

|

For example, if the price granularity is -3, and the value

is 1500, the price is 1.500 currency units.

|

|

Stream Start

|

The Start Date and Time for a bound CTS Stream

|

See WS-Calendar Date-Time in Section 3.1.

|

|

Stream Intervals

|

The ordered set of Stream Intervals

|

The set of Intervals is ordered by means of a local

UID which is concatenated with the Stream UID as described in [Streams] and

in [EI]

|

Table 5‑2:

Stream Interval Attributes

|

Attribute

|

Meaning

|

Notes

|

|

Stream Price Value

|

The Price value for this specific Stream Interval,

subject to indicated Scale/Granularity

|

At least one of (Stream Price Value, Stream Quantity

Value) MUST be present.

|

|

Stream Quantity Value

|

The Quantity value for this specific Stream Interval,

subject to indicated Scale/Granularity

|

At least one of (Stream Price Value, Stream Quantity

Value) MUST be present.

|

|

UID

|

A “Local UID” used to order the Interval within the

Stream

|

As conformant CTS implementations need not be owned

by the same implementer, intermarket gateways (however defined) may

deserialize and re-serialize to different specifications

|

Background (adapted from [EI])

A valid Party ID is required to interact with a Market and

is included in most payloads.

Party Registration is described in EI. This facet describes the

messages necessary for an actor to register and obtain a Party ID in order to

participate in a Market.

-

EiCreateParty associates an actor with a Party ID and informs the

Marketplace of that ID. CTS makes no representation on whether that ID is an

immutable characteristic, such as a MAC address, a stable network address, such

as an IP, or assigned during registration,

-

EiRegisterParty names the exchange of information about an actor

that enables full participation in a CTS Marketplace. It may exchange

information needed for financial transfers including, perhaps, reference to an

existing customer or vendor ID, or proof of financial bond for large

participants, or issuance of crypto-tokens, or any other local market

requirements. A Registered Party is ready to be a full participant in the local

Market.

-

Cancel Party Registration removes a Party from the Market. It may

include final settlement, cancellation of outstanding Tenders, backing out of

future contracts, or other activities as defined in a particular CTS

Marketplace.

Aside from the business services as described, Party

Registration may have additional low-level requirements tied to the protocol

itself used in a particular implementation based on CTS.

This specification does not attempt to standardize these

interactions and messages beyond naming the Register Party facet. A more

complete discussion can be found in the [EI] specification.

Some Marketplaces MAY wish to associate one or more

measurement points with a Party. Such measurement points could be used to audit

Transaction completion, to assess charges for using uncontracted for energy,

etc. Measurement points are referenced in Section 12

“Delivery Facet”, Markets that require this functionality may

want to include an enumeration of Measurement Points in Party Registration.

The Marketplace facet is an extension of [EI]. In CTS the

Marketplace includes all the Markets wherein a Party can trade, and are

associated with all the Products a Party can trade for.

For example, where all trading is in a single microgrid, the

Marketplace is implicitly tied to that microgrid. Where trading is across a

city or across a traditional utility or across a region the Marketplace hosts

all Market interactions for that utility or region. Nothing in this

specification prohibits multiple Marketplaces, such as a Wholesale or a Retail,

or a sourced Marketplace such as Solar.

Using the Resource / Product / Instrument terminology, each

Product has its own market, and these different markets may have different

rules, or different matching engines. All are in the same Marketplace.

The Marketplace Facet defines characteristics common to all

the local Markets, and catalogs how to participate in each Market.

Market Contexts in [EMIX] and [EI] are URIs and are used to request

information about the Market or Marketplace that rarely changes, so it is not

necessary to communicate it with each message.

Note that a Market Context is associated with and identifies

a collection of values and behaviors; while an [EI] implementation MAY use

operations such as POST to a Market Context URI, that behavior is not required.

For any Marketplace, there are standing terms and

expectations about Product offerings. If these standing terms and expectations

are not known, many exchanges may need to occur before finding Products and Tenders

that meet those expectations. If all information about the Marketplace were to

be transmitted in every information exchange, messages would be overly

repetitive.

The scope of a Party ID is a Marketplace. The Party ID MUST

be unique within a Marketplace.

Only the acquiring of Party ID is in scope in the following

list:

- Obtain

Party ID

- Establish

billing terms, if any

- Exchange

Location, if required

See Party Registration Facet for more information.

An Actor MUST interact with a specific Market to trade a

specific Product. A Market matches Tenders for all Instruments based on a given

Product. The matching engine is contained within the Market and different

matching engines have no visibility past the Market Facet.

The Marketplace Facet enables a Party to request the details

of a Marketplace and the Markets contained in the Marketplace. Using the Marketplace

Facet for discovery, Parties MAY request and compare Market Characteristics to

select which markets to participate in.

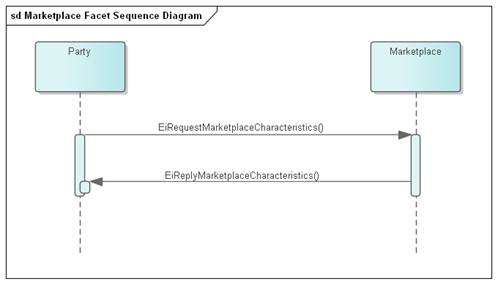

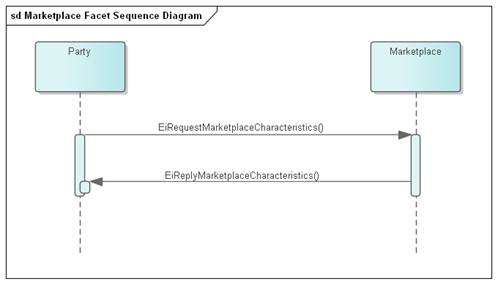

Figure 7‑1: UML Sequence Diagram for the Markeplacet

Facet

Once Markets are identified as a candidate, the Market Facet

can retrieve the standard terms associated with those Markets. See Market Facet.

Table 7‑1

Information Model for the Marketplace Facet

|

Attribute

|

Attribute

Name

|

Attribute

Type

|

Meaning

|

|

Marketplace

Name

|

NAME

|

String

|

Text

providing a descriptive name for a Marketplace. While the Name MAY be

displayed in a user interface; it is not meaningful to the Actors.

|

|

Currency

|

CURRENCY

|

String

|

String

indicating how value is denominated in a market. If fiat currency, should be

selected from current codes maintained by UN CEFACT. May also be

cryptocurrencies or local currency.

|

|

Time

Offset

|

T_OFFSET

|

Long

|

A

Duration that some Marketplaces MAY use to describe trading where a first

interval is not on an hourly boundary.

|

|

Time

Zone

|

TZ

|

String

|

A

Time Zone indicates how all Times and Dates are expressed.

|

|

Price

Decimal Fraction Digits

|

PRICE_FRAC

|

Long

|

Some

market implementations use a Marketplace-wide indication of how many decimal

fraction digits are used.

|

|

Resource

Descriptor

|

RESOURCE

|

String

|

The

Resource traded in this Market.

|

|

Markets

|

MARKETS

|

Market

Description

|

A

list of Market Descriptions for each Market contained in the Marketplace.

|

Market Descriptions in a Marketplace

A marketplace itemizes each of the Markets in the

marketplace. This is indicated by a set of Market Descriptors with the

following attributes, one for each contained Market:

Table 7‑2

Market Description

|

Attribute

|

Attribute

Name

|

Attribute

Type

|

Meaning

|

|

Market

Name

|

MARKET

|

String

|

Optional

text providing a descriptive name for a Market. While the Name MAY be

displayed in a user interface; it is not meaningful to the Actors.

|

|

Resource

|

Resource

|

Resource

Designator

|

[Extensible]

enumeration indicating what is sold in each Market

|

|

URI

|

MARKET-URI

|

String

|

URI

to access the Market.

|

Descriptions of the Product found

in each Market are found in each Market and are not replicated into the

Marketplace.

All interactions in a Market are subject to Standard Terms which

are discovered through the Market Facet.

1. A Party

interacts with the Marketplace to discover all Markets in which the Resources

the Party is interested in are traded.

2. A Party

queries each of the Markets trading that Resource discover the Products in each

Market, and the Standard Terms for each.

3. Resources

with Warrants are in their own Markets, which may have their own Standard

Terms. The Warrant is a Market Term.

4. The Party

uses the Party ID determined during Marketplace Registration for all Tenders.

5. The Party

determines which Products it wants by submitting Tenders to the Market is

chooses.

6. Each

Tender is for a specific Instrument, which is the Market Product plus a

Starting Time.

A Market matches Tenders to create Transactions using the

Tender and Transaction Facets.

While there is no standard matching algorithm defined in

CTS, the Standard Terms include indicators of how the Market matches Tenders.

For example, different bidding strategies may be used when submitting to a

double auction market than for an order book market.

Interactions with the Market are through the Tender (see

Section 9) and Transaction (see Section 10) Facets.

Market Contexts in [EMIX] and [EI] are URIs and express

Standard Terms that rarely changes, so it is not necessary to communicate it

with each message.

In CTS, this is refined to the Marketplace Facet (Section 7) and the Market Facet (Section 8).

|

Facet

|

Request Payload

|

Response Payload

|

Notes

|

|

Market

|

EiRequestMarketCharacteristcs

|

EiReplyMarketCharacteristcs

|

Request specific Market

Characteristics

|

An Actor interacts with a specific Market to trade a

specific Product. A Market matches Tenders for all Instruments based on a given

Product. The matching engine is contained within the Market and different

matching engines have no visibility past the Market Facet.

The Market Facet enables a Party to request the details of a

Marketplace. Using the Market Facet, Parties MAY be able to request and compare

Market Contexts to select which markets to participate in.

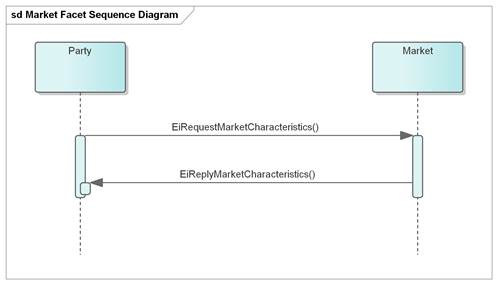

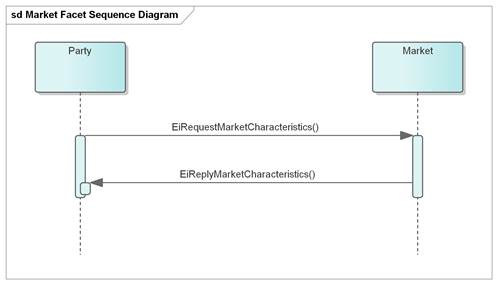

Figure 8‑1:

UML Sequence Diagram for the Market Facet. TODO: Update for Market Facet

The Market Facet can be used to retrieve the standard terms

associated with a Market.

An EiRequestMarketCharacteristics payload requests the

standard terms for a Market; the reply payload EiReplyMarketCharacteristics

returns those terms as name-value pairs.

Figure

8‑2: UML of Market Facet payloads

8.4 Information Model for the Market Facet

Sending an EiRequestMarketCharacteristics payload

referencing a Market requests standard terms as given in Table 8‑1:

Standard Terms .

These are derived and extended from EMIX Terms; those are

extrinsic to the Product delivery but effect how each Party interacts with

others. Terms may be tied to basic operational needs, or schedules of

availability, or limits on bids and prices acceptability.

The CTS Standard Terms MAY be extended to reflect additional

capabilities and description.

Strings returned for attribute values MUST be no longer than

256 bytes.

TODO Consider requiring

resolvable URIs for contexts, or pairing with potential transport endpoints.

Table 8‑1: Standard Terms returned by Market

Facet

|

Attribute

|

Attribute

Name

|

Attribute

Type

|

Meaning

|

|

Market

Name

|

NAME

|

String

|

Text

providing a descriptive name for a Market. While the Name MAY be displayed in

a user interface; it is not meaningful to the Actors.

|

|

Currency

|

CURRENCY

|

String

|

String

indicating how value is denominated in a market. If fiat currency, should be

selected from current codes maintained by UN CEFACT. May also be

cryptocurrencies or local currency.

|

|

Time

Offset

|

T_OFFSET

|

Long

|

A

Duration that some Marketplaces MAY use to describe trading where a first

interval is not on an hourly boundary.

|

|

Time

Zone

|

TZ

|

String

|

A

Time Zone indicates how all Times and Dates are expressed.

|

|

Price

Decimal Fraction Digits

|

PRICE_FRAC

|

Long

|

Some

market implementations use a Marketplace-wide indication of how many decimal

fraction digits are used.

|

|

Market

Party ID

|

MPARTYID

|

String

|

The

PartyID to use in a Tender (reference 2.2.3)

|

|

Bilateral

OK

|

BILATERALOK

|

Long

|

Boolean

expressed as an integer:

0

- False—bilateral Tenders or Transactions not permitted, only Market Tenders

1

- True—bilateral Tenders or Transactions with identified parties are

permitted.

|

|

Resource

Designator

|

R_ID

|

Resource

Designator

|

[Extensible]

enumeration indicating the Resource traded in this Market. This establishes

the Resource Designator used in Product definitions and in messages

|

|

Containing

Marketplace

|

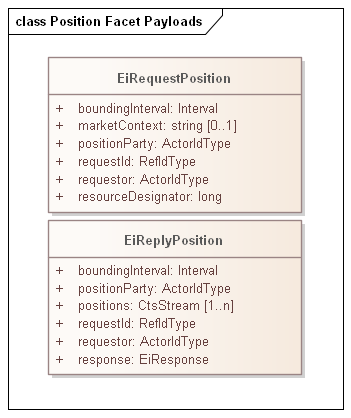

MPLACE

|

String

|

URI

for Marketplace Context

|

|

Product

|

PRODUCT

|

Array of Ordered

Pairs

|

See Product Definition, Table 8‑2: Elements that

define Products in a Market. It SHALL match the Product Definition indicated

in the Marketplace for this Market.

|

|

Tender

Grouping

|

TGROUP

|

Long

|

Enumeration expressed as an integer for treatment of multiple

tenders either in a single EiCreateTender payload or across all Tenders for

the same Instrument:

0

– Tenders are independent (JBOT)

1

– All Tenders within a single EiCreateTenderPayload SHALL BE treated by the

market as points on a supply or demand curve as indicated by the Side of the

Tenders (ALLINPAYLOAD)

|

|

Clearing

Approach

|

CLEAR

|

Long

|

Enumeration expressed as an integer to describe market

clearing approach:

0 – CONTINUOUS – continuous clearing

1 – PERIODIC – not continuous, typically with

periodicity related to Product T_GRAIN.

|

|

Clearing

Duration

|

CLEAR-DURATION

|

String

|

Duration

before Instrument start time used for market matches. Only valid if Clearing

Approach is 1 – PERIODIC Not valid if Periodic Time is specified. “All

matches on the hourly market are made 30 minutes before the hour”

|

|

Clearing

Time

|

CLEAR-TIME

|

String

|

Time

for market matches. Only valid if Clearing Approach is 1 – PERIODIC Not valid if

Periodic Duration is specified. “All matches on the Day-Ahead hourly

market are made at 3:00 PM”.Table 9-1

|

|

Clearing

Days Ahead

|

CLEAR-DA

|

Long

|

Number

of days prior to the Instruments for the CLEAR-TIME. For example if a Two-day

ahead market clears at 3pm, CLEAR-DA = 2 and CLEAR-TIME = “3:00PM”

|

|

All

transactions for an Instrument at the same clearing price

|

ALL_AT_CLEAR

|

Long

|

Boolean

expressed as integer

0

- False—Tenders for a specific Instrument MAY clear at different prices.

1

- True—As in Double Auction, all participants clear at the same price.

|

|

Maximum

|

MAX

|

Integer

|

Maximum

Transaction size the Market will accept.

|

|

Quote

Reference

|

QUOTE-REF

|

String

|

A

string indicating the Quote Reference for this Market to which an actor may

subscribe or unsubscribe.

|

|

Ticker

Reference

|

TICKER-REF

|

String

|

A

string indicating the Ticker Reference for this Market to which an actor may

subscribe or unsubscribe.

|

Each Product in a Marketplace is defined using attributes as

below

Table

8‑2: Elements that define Products in a Market

|

Attribute

|

Attribute

Name

|

Meaning

|

|

Resource

Designator

|

R_ID

|

[Extensible]

enumeration indicating the required Resource

|

|

Time

Granularity

|

T_GRAIN

|

The

interval duration in seconds for the specific Product definition

|

|

Quantity

Scale

|

Q_SCALE

|

The

exponent of the Quantity. For example, a Product denominated in kilowatts has

a Q_SCALE of 3.

|

|

Quantity

Granularity

|

Q_GRAIN

|

The

allowed quantity unit size, e.g. Q_GRAIN == 10 means that a Tender for 9

units will be rejected but any multiple of 10 will be accepted.

|

|

Price

Granularity

|

PRICE_GRAIN

|

The

allowed price unit, e.g. Price Granularity == 10 means that that any multiple

of 10 CURRENCY units is acceptable, but any price not matching, say a price

of 9 CURRENCY units, is rejected. May be negative as in -3, Prices are

multiples of .001.

|

|

Market

|

MARKET

|

The

message endpoint to access the market where this Product is traded.

|

|

Warrants

|

WARRANT

|

Optional

further specificity of Product

|

The terminology of this section is

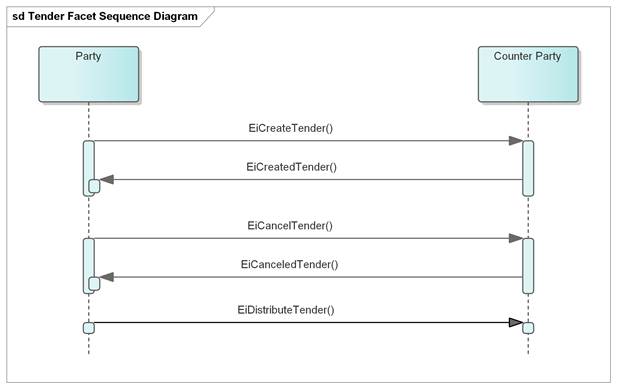

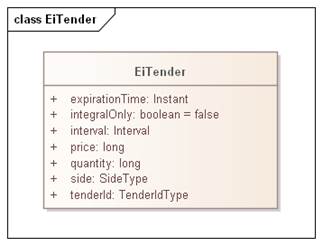

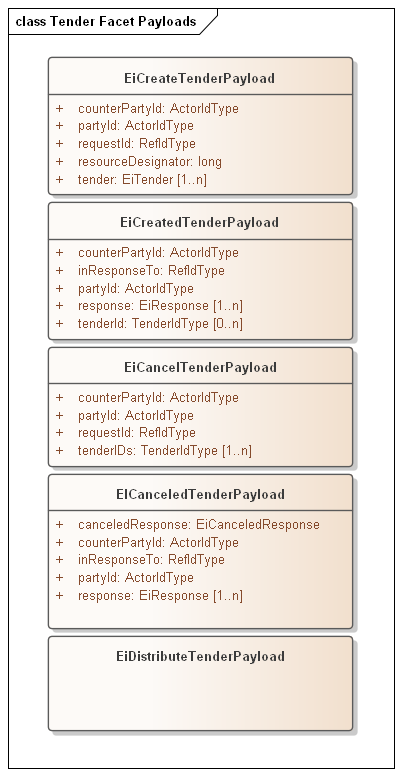

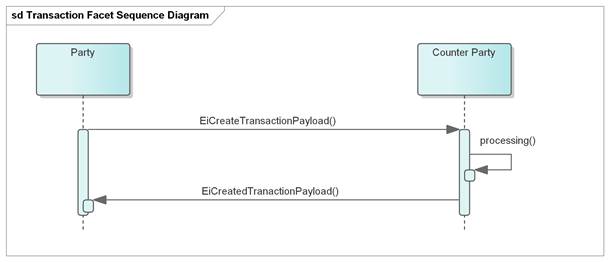

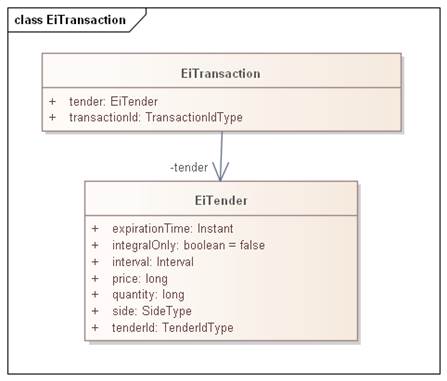

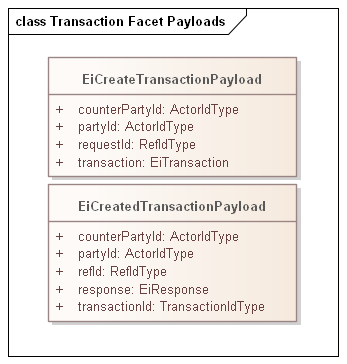

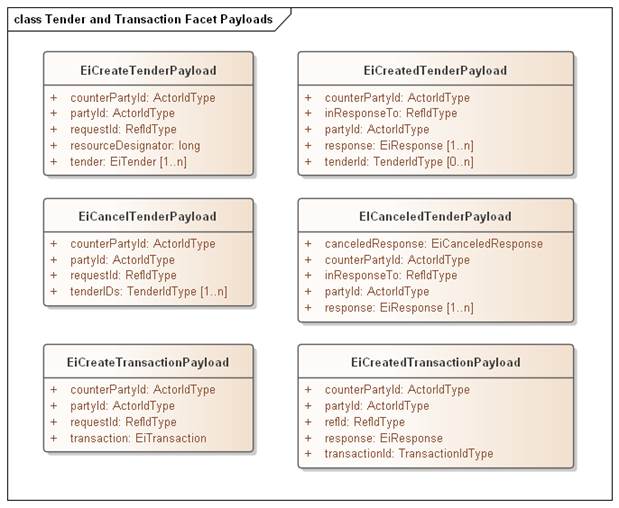

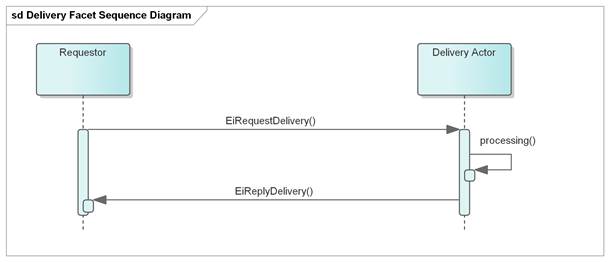

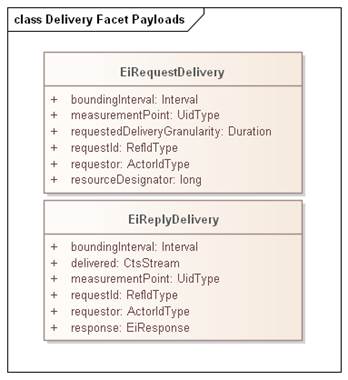

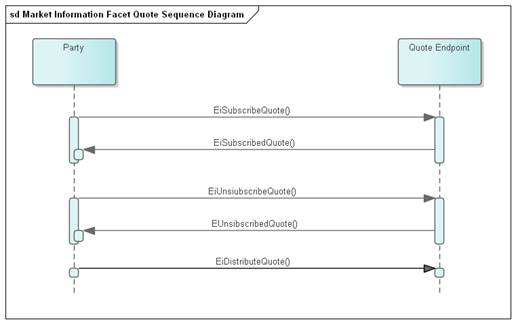

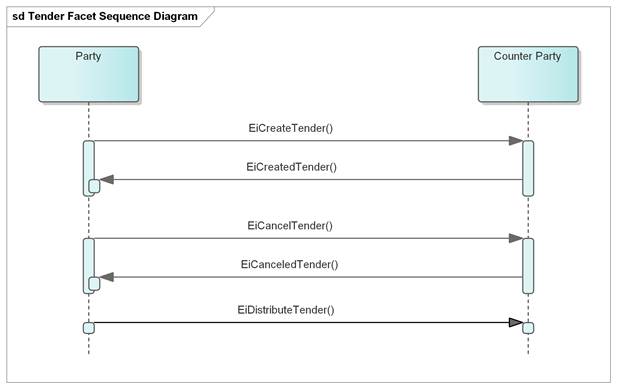

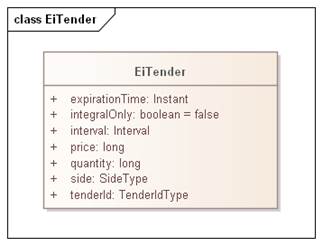

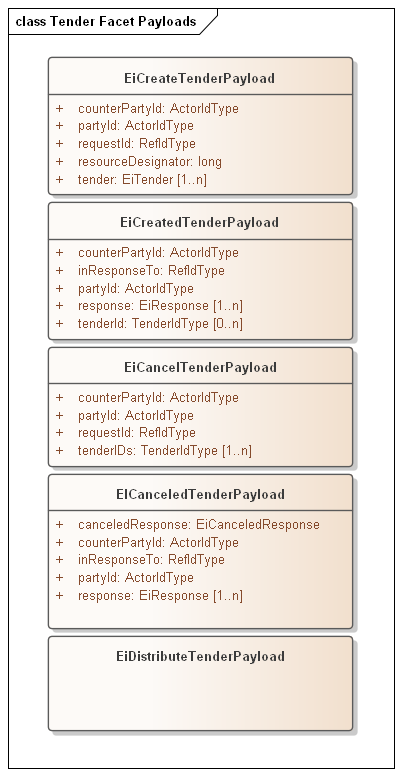

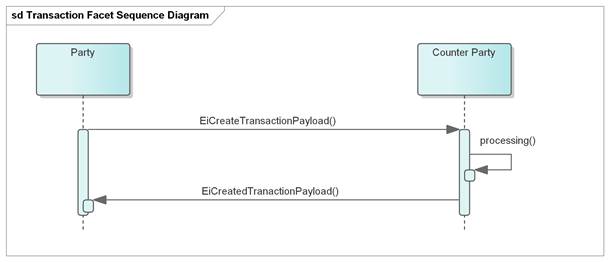

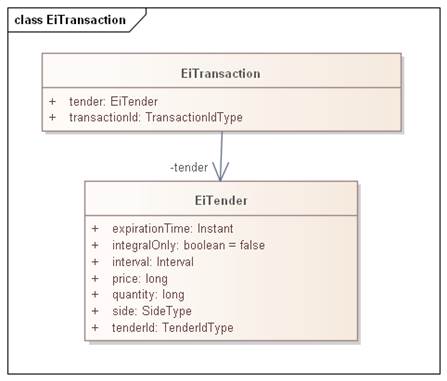

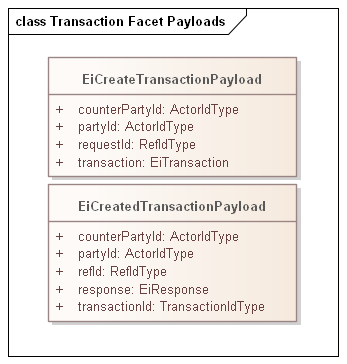

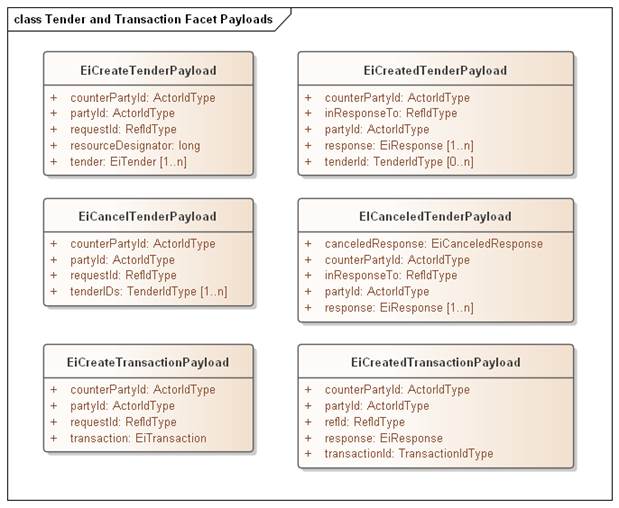

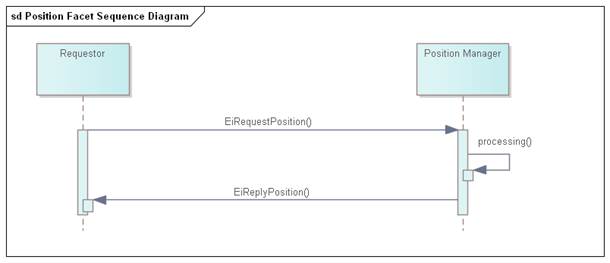

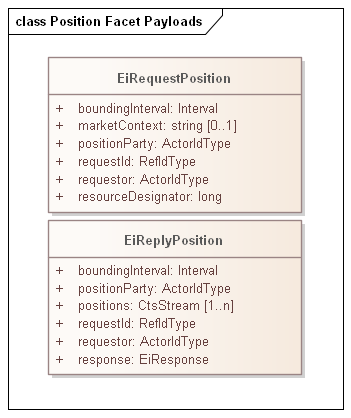

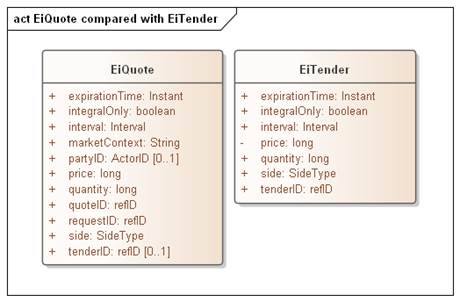

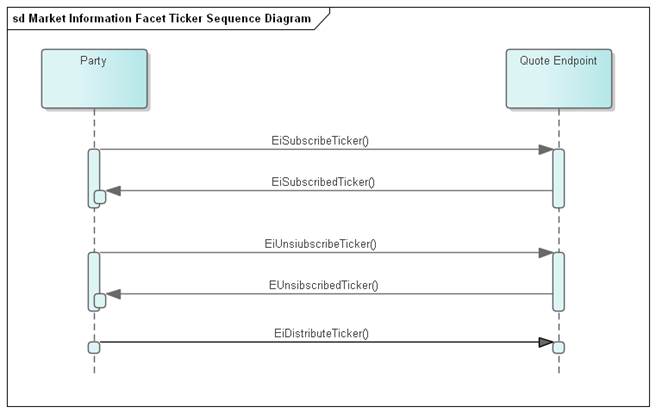

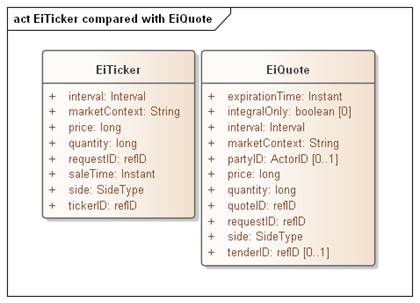

that of business agreements: Tender and Transaction. The Service descriptions