This section is informative.

This document defines a series of schemas that enable

individuals to share Verifiable Credentials and Claims for “electronic Know

Your Customer” (eKYC) processes.

The goal of this document is to facilitate verifiability,

extensibility and semantic interoperability for user-controlled eKYC

credentials.

This document defines schemas that are based on the W3C

Verifiable Credential Data Model 2.0 [W3C DM2] and the W3C Verifiable Credentials JSON Schema

Specification [W3C

VCJS]. The schemas defined

herein are also aligned with related OpenID Foundation standards [OIDC] and

recommendations of the ITU-T [ITUT1252, ITUT1254].

This is the

first version of the document.

This section is not normative.

attribute

information bound to an Entity that

specifies a characteristic of the Entity

Note: An attribute is a synonym for a

Claim.

claim

assertion made about a Subject

credential

set of one or more claims made by an Issuer

Note: The claims in a credential can be

about different subjects.

Credential Schema

data model used to verify the structure and

semantics of the set of claims specified in a credential

Decentralized Identifier (DID)

portable URL-based identifier associated

with an entity

Note 1: An example of a DID is

“did:example:123456abcdef”

Note 2: DIDs are most often associated with

a Subject in a Verifiable Credential.

Decentralized Identifier document

(DIDdoc)

document containing information related to

a DID

Note: DIDdocs are accessible from a

verifiable data registry.

electronic Know Your Customer (eKYC)

digital process for remotely verifying the

identity of individuals or businesses

Note 1: eKYC processes may have varying

levels of validity assurance.

Note 2: Remote verification can include

in-person evidence collection.

Note 3: Customer knowledge can vary from a

simple self-asserted name to in-depth investigations for regulatory purposes.

entity

thing that can be referenced in statements

as an abstract or concrete noun

Note 1: Entities include but are not

limited to people, organizations, physical things, documents, abstract

concepts, numbers, and strings.

Note 2: An Entity can perform a role in an

ecosystem if it is capable of doing so – some entities fundamentally cannot

take actions, for example, the string "abc" cannot issue credentials.

Holder

role that processes and consents to the

presentation of Verifiable Credentials

Note 1: The Holder is often, but not

always, the Subject of the VC being processed.

Note 2: Holders store the credentials in

credential repositories.

identity

representation of an entity as one or more

attributes that allow the entity or entities to be sufficiently distinguished

within a context

Identity Provider

(IdP)

entity that performs the role of Verifiable

Credential issuer

Note 1: An identity provider, also known as

an identity service provider (IdSP), is an entity that verifies, maintains,

manages and can create and assign identity information of other entities.

Issuer / Credential Issuer

entity that asserts claims about Subjects

and issues Verifiable Credentials

Note 1: Issuer functions include identity

proofing, VC storage, and VC life cycle management (updates, revocations)

Note 2: Issuers deliver VCs to Holders or to

a Holder-controlled Credential Repository.

presentation

claim data derived from one or more

credentials

Note 1: Credentials are issued by one or

more Credential Issuers.

Note 2: A presentation is delivered a

specific Verifier.

Service Provider (SP)

entity that offers products or services to

qualified users

Note 1: A Service Provider is often

referred to as a “relying party”.

Note 2: For example, a Verifier is a role

of the Service Provider. Other business roles could include shopping cart,

payment processor, service delivery, etc.

Subject

thing about which claims are made

User

entity that requests a product or service

from a Service Provider

Note 1: A User is often referred to as a

“customer”, “client”, or “buyer”.

Note 2: A User can perform the role of

Holder or Subject.

Verifiable Credential (VC)

tamper-evident

credential that has authorship that can be cryptographically verified

verifiable data registry

role for mediating the creation and

verification of identifiers, keys and other data relevant to the use of VCs

Note 1: Relevant data can include but is

not limited to VC schemas, revocation registries, issuer public keys.

Verifiable Presentation (VP):

tamper-evident

presentation whose authorship can be trusted after completing a process of

cryptographic verification

Note 1: Certain types

of VPs include data that is synthesized from, but does not contain, the

original VCs (for example,

zero-knowledge proofs).

verification

process for determining whether a

verifiable credential or verifiable presentation is an authentic and timely

statement from an Issuer or User, respectively

Note 1: The verification process checks the

VC or VP for compliance to an associated schema, that the proof method is

satisfied and, if present, that the status check succeeds.

Note 2: Verification of a credential does

not imply a successful evaluation of the truth of the claims encoded in the

credential.

Verifier

role that receives Verifiable Credentials

and Verifiable Presentations for verification processing

CI Credential Issuer

DID Decentralized Identifier

DIDdoc Decentralized Identifier

document

DIE Digital Identity

Ecosystem

eKYC electronic Know Your

Customer

IdP Identity Provider

IdSP Identity Service Provider

IETF Internet Engineering

Task Force

ITU-T International

Telecommunication Union – Telecommunications Standardization Sector

JSON JavaScript Object

Notation

JWT JSON Web Token

SD-JWT Selective Disclosure JWT

NIST National Institute of

Standards and Technology

SP Service Provider

URL uniform resource

locator

VC Verifiable Credential

VP Verifiable Presentation

W3C World Wide Web

Consortium

The key words

"MUST", "MUST NOT", "REQUIRED",

"SHALL", "SHALL NOT", "SHOULD", "SHOULD

NOT", "RECOMMENDED", "NOT RECOMMENDED",

"MAY", and "OPTIONAL" in this document are to be

interpreted as described in BCP 14 [RFC2119] and [RFC8174] when, and only when, they appear in all capitals, as

shown here.

This section is informative.

Modern information

systems depend on rapid and continuous access to authentic, accurate digital identity

information regardless of location, technology, or entity type. Users, on the

other hand, want to control access to and use of their identity and personal

data. User control is deemed to be a fundamental requirement for most digital

transformation initiatives. This is the impetus for decentralizing the

management of identities and for creating a “zero trust” environment for system

access control.

Verifiable Credentials

(VCs), as defined by the W3C [W3C DM2],

support digital identity ecosystems that are standards-based, interoperable,

privacy-preserving, de-centralized and trustworthy. Interoperability is

critical since digital identity ecosystems are typically multivendor, multiuser

and multi-purpose. Trust and privacy are also essential characteristics,

especially for critical infrastructures and social networks.

This document

specifies JSON schema templates for Verifiable Credentials that can help to

accelerate the transition to electronic Know Your Customer (eKYC) services,

processes and practices. The concept of KYC is broadly applied to assurance

levels ranging from self-attested statements to fully-vetted, legally-accepted

credentials.

This document

describes VC schemas covering eKYC for persons (i.e., individuals); it does not

include non-human entities such as organizations, animals, sensors or abstract

objects.

A Claim is a

statement of fact about a human Subject. Other Subject types – IoT devices, OT

endpoints, application agents and chatbots, for example – are for future

consideration.

Claim types can

include, but are not limited to:

-

attributes: features or characteristics of the Subject,

especially permanent or long-lasting characteristics such as a name, date of

birth or eye color;

-

eligibilities: permissions or rights assigned to a Subject

for a period of time (e.g., permission to drive a car or to practice medicine);

-

contextual: information that describes or frames a Subject

including family relationships, employers, current residence, education,

physical limitations, unique features, experiences, etc.

Credentials are

sets of claims. Credentials are data objects that form the payloads for

transactions in the Digital Identity Ecosystem. To ensure scalability,

interoperability and efficiency, credentials must be verifiable, trustworthy,

meaningful, accepted by, and useful to the Digital Identity Ecosystem

participants.

The goal for

Credential Issuers is to generate and issue credentials that meet (or exceed)

the functional and quality requirements of Service Providers with little or no

variation and processing. This can be facilitated by adopting the common

credential schemas that are defined in this document.

Credentials include, but are not limited to:

-

a reference to the Subject

(for example, a photo or name);

-

the type of credential (for

example, a Dutch passport, an US driving license, or a Canadian health card);

-

a reference to the

credential schema (the structure and contents of the credential);

-

a unique Subject identifier

(such as a social security number, a DID, or an arbitrary serial number);

-

one or more claims being

asserted by recognized authorities (for example, the nationality of the Subject

at birth, vehicle types the Subject is allowed to drive, the date of birth);

-

the name of the accredited issuer

(e.g., a city government, a national agency, or a certified issuer); and

-

constraints on the

credential (for example, its validity period or terms of use).

For example, Figure 1 illustrates the user

data of an unsecured payload for an identity credential that includes the

Subject’s name and age.

|

{

"$schema": "https://json-schema.org/draft/2020-12/schema#",

“title”: “exampleSchema”,

“description”: “Example

of a Minimal Schema”,

"type": "object",

"properties": {

"name": {

"type": "string"

},

"age": {

"type": "integer"

}

},

"required": ["name", "age"]

}

|

|

In

this example:

- $schema - specifies the JSON Schema version.

- title - an optional title property.

- description - an optional description property.

- type - indicates that the data structure is an

object.

- properties - defines the properties name and age

and their types.

- required - lists the properties that must be

present in the object.

|

Figure

1: Example of an identity credential schema

Claims about a

Subject can be divided into:

-

Subject identifier

information – information that

can be used to distinguish one person from another with a specified assurance

of uniqueness within a specified domain (e.g., a country). In general, an

individual’s common name is not sufficient to be a unique identifier.

-

Subject-related information – additional facts about the Subject that is

context- or application-dependent. Restrictions on a driver’s license (e.g.

must wear glasses) is an example.

Identity claims

include the person’s name, age, hair color, eye color, birth date, birth city,

parent’s names, etc. One objective is to use enough claims to ensure uniqueness

without unnecessarily disclosing personal information. Identity claims that are

stable help to minimize re-issuance requirement (e.g., a birth date never

changes).

Related data

includes any information that is needed by a requestor (usually a supplier of products

or services). For example, claims could refer to different, unrelated Subjects

such as claims about a parent and his/her children. A credential may not

include any claims about the Subject identity. For example, a parent may be the

Subject of a credential in which all the claims are about the children.

An organization

that supplies credentials is serving in the Credential Issuer role. This role

is responsible for signing and issuing a credential to its approved Holder. The

same organization may also perform other roles including acquiring and

validating the claims and packaging the claims into verifiable credentials.

Organizations must be authorized to issue the credential type; for example, a

driver’s license is normally only issued by a specific government department.

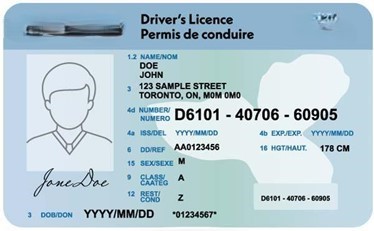

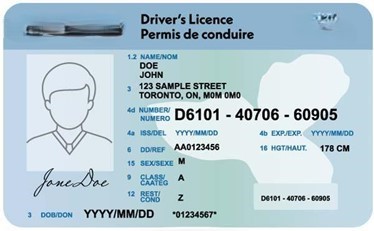

Example

A physical

driver’s license is an example of a credential that includes multiple claims.

The main purpose of the driver’s license is to state that the named individual

(the Subject) is legally allowed to operate a motor vehicle, possibly with

restrictions such as “must wear glasses” or “applies only for passenger

vehicles.” Many driver’s licenses also include a date of birth, an address that

was valid at the time of issuance, a picture and a signature, all of which have

been validated by a government office through physical presence and examination

of evidence.

Figure

2: Example of a Driver’s License Credential

People can be uniquely

identified and differentiated by collecting and validating (“proofing”) attributes

or claims about them, including but not limited to their name, address, age,

eye color, height, gender and nationality. Although the assurance of uniqueness

increases with the number of claims and the robustness of the validation

process, a relatively small set is usually sufficient for identification within

a specific scope, context or geographic region. For example, in a city there

would typically be only one person in a city with a given first name, last name,

age and phone number (four claims). Addition of a verified address and driver’s

license would increase the assurance of a person’s uniqueness to a national or

global level.

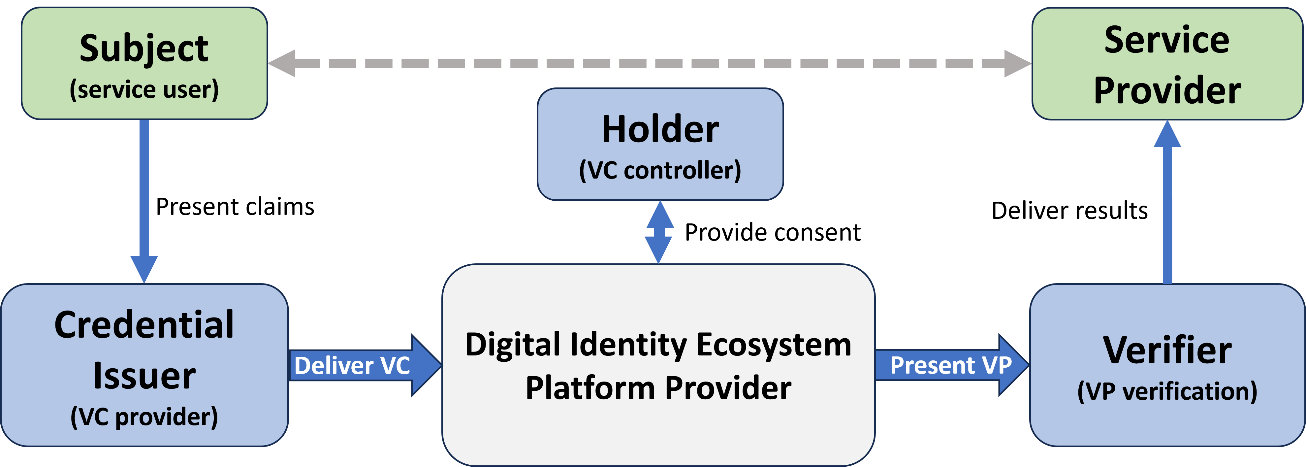

A Digital Identity

“ecosystem” is a set of actors and technology platforms used for digital

identification processes including ingesting and validating identity claims,

packaging validated claims into VCs, and presenting the VCs to organizations that

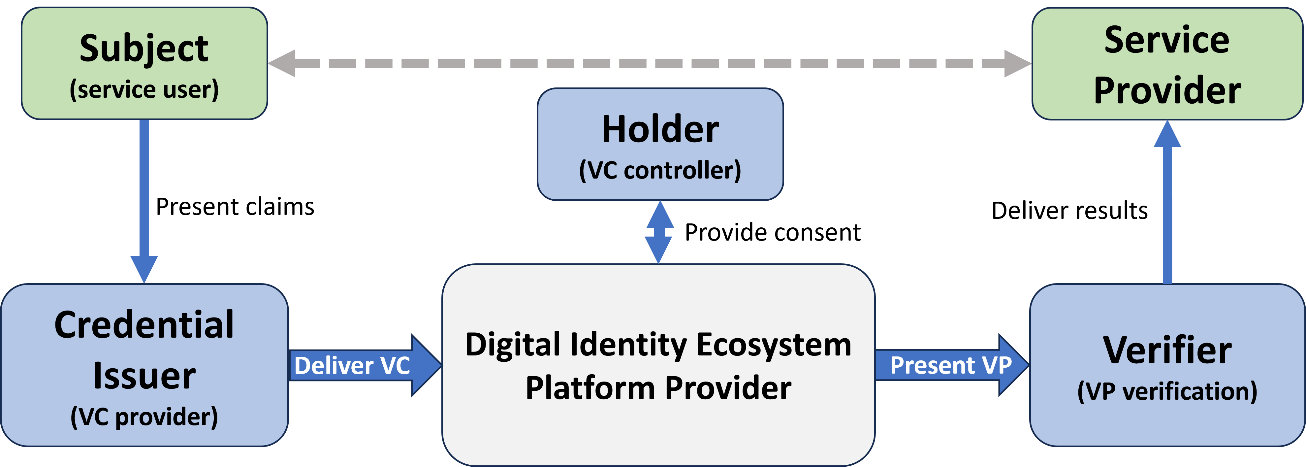

have a “need to know.” Figure 3 illustrates the parties in a Digital Identity Ecosystem

– in practice, there will be many Subjects/Holders and many Service Providers with

a smaller number of Credential Issuers, Verifiers and Platforms.

x

Figure

3: Parties in a Digital Identity Ecosystem

A Subject can be

an individual, organization, device or any other object that has independent

existence and is separately identifiable. The User of the products and services

offered by the Service Provider is usually the Subject that is to be identified.

Note: This

standard currently applies only to human Subjects.

A Digital

Identify Ecosystem enables Subjects to digitally identify themselves in a

robust, reliable and re-usable manner. It also allows for secure delivery of related

digital information that complements the identity.

A Holder is an individual

or their proxy that is responsible for handling credentials on behalf of an

associated Subject. A Holder can also be the Subject, but this is not

mandatory.

The Holder interacts with

the Credential Issuer to acquire VCs and with the Service Provider to agree on which

credentials are required. The Holder consents to the presentation of

credentials when available.

A Holder’s device or

system includes a role to securely and privately store VCs and other

information of concern to the Digital Identity Ecosystem. This role is

typically referred to as a “wallet.”

A Wallet can be

a role of a Holder’s device or be provided by a third party.

A Credential

Issuer (CI) is an accredited organization that generates, certifies and issues validated

credentials.

A CI is

responsible for acquiring claims from a Subject, assessing evidence of claim validity,

assigning validation assurance levels, packaging claims into Verifiable Credentials

in accordance with governance policies, and issuing the Verifiable Credentials

to authorized Holders.

A CI can be an independent

organization or a role within an organization (for example, a Service Provider that

performs CI functions for its customers).

An Identity Credential

Issuer is a specialized CI that only issues core identity-related credentials.

They are also known as an Identity Providers (IdP) or Identity Service Providers

(IdSP).

An Identity

Credential Issuer can be a role of a Credential Issuer or a separate 3rd

party organization.

A Biometric Credential

Issuer is a specialized CI that generates biometric information, creates

biometric templates and issues biometric claims or credentials.

A Biometric

Credential Issuer can be a Credential Issuer role or a separate 3rd

party organization. They may also specialize in different forms of biometrics

(e.g., fingerprints or facial recognition).

A Service

Provider (SP) is an organization that supplies products or services to a

Subject.

An SP is

responsible for defining which credentials are required, verifying presented credentials,

meeting regulatory and legal requirements (such as age restrictions) and then delivering

the requested products or services. To meet its obligations, the Service

Provider needs specific context-dependent information from the Holder.

The choice of

products or services offered by the Service Provider and the information

required is outside the scope of the Digital Identity Ecosystem.

A Verifier is a Service

Provider role that provides VC verification functions. An alternate name for a

Verifier is a Relying Party.

A Verifier can

be a Service Provider role or be a service offered by a separate 3rd

party organization.

A platform

provider in a Digital Identity Ecosystem provides services such as the verifiable

data registry [W3C DM2]. The W3C defines a Verifiable Data Registry as:

“A role a system

might perform by mediating the creation and verification of identifiers,

verification material, and other relevant data, such as verifiable credential

schemas, revocation registries, and so on, which might require using verifiable

credentials. Some configurations might require correlatable identifiers for

subjects. Some registries, such as ones for UUIDs and verification material,

might act as namespaces for identifiers.”

Platform Providers

also provide services for entity enrollment, safe storage and transfer of VCs,

and enforcement of governance policies.

A Platform

Provider can optionally offer wallet-like functions as an alternative to or in

cooperation with the Holder’s device. This includes providing functions for

acquiring VCs, selecting claims for disclosure to SPs, and brokering consent to

disclose the various claims in VPs.

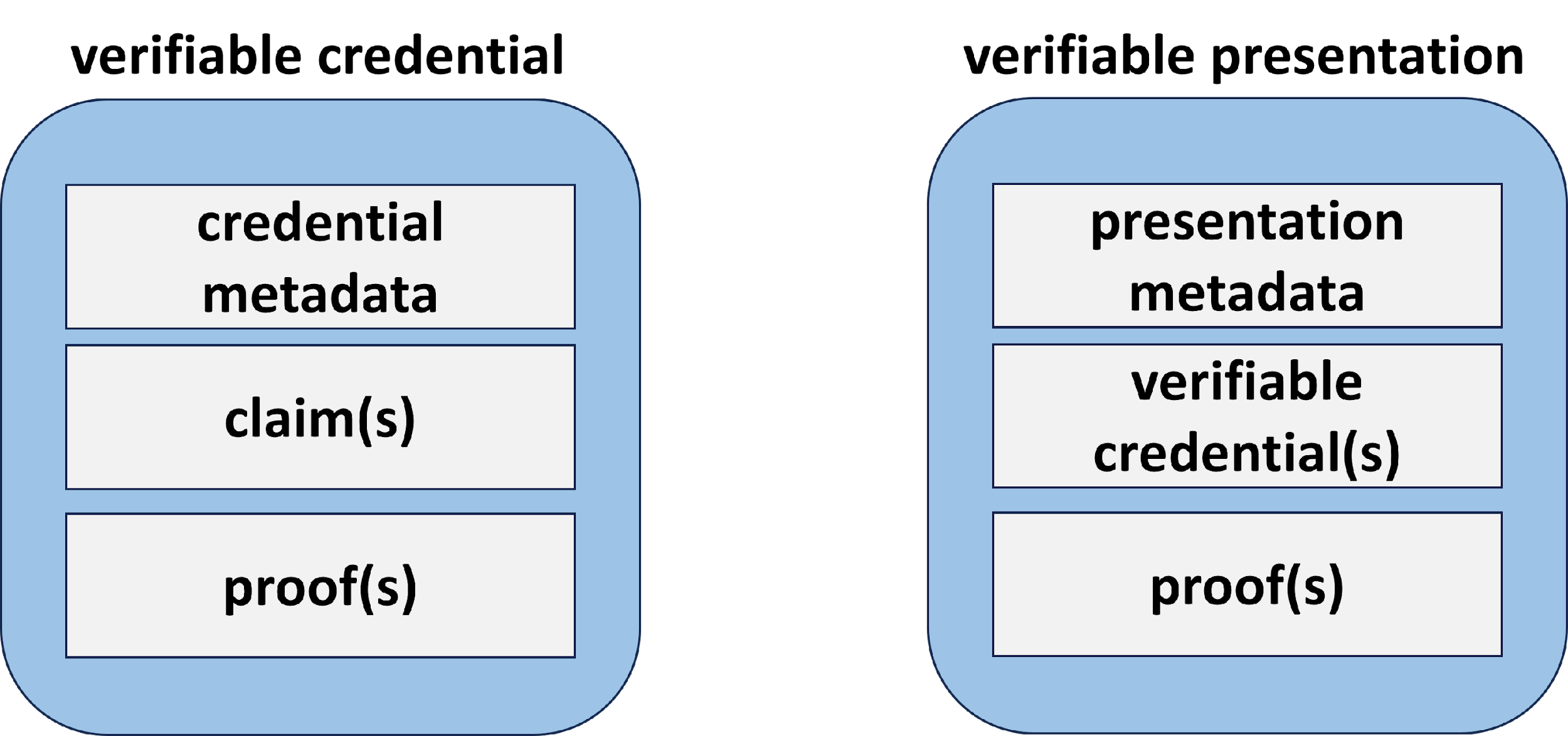

A credential is said to be verifiable when a trusted

Credential Issuer has cryptographically signed it.

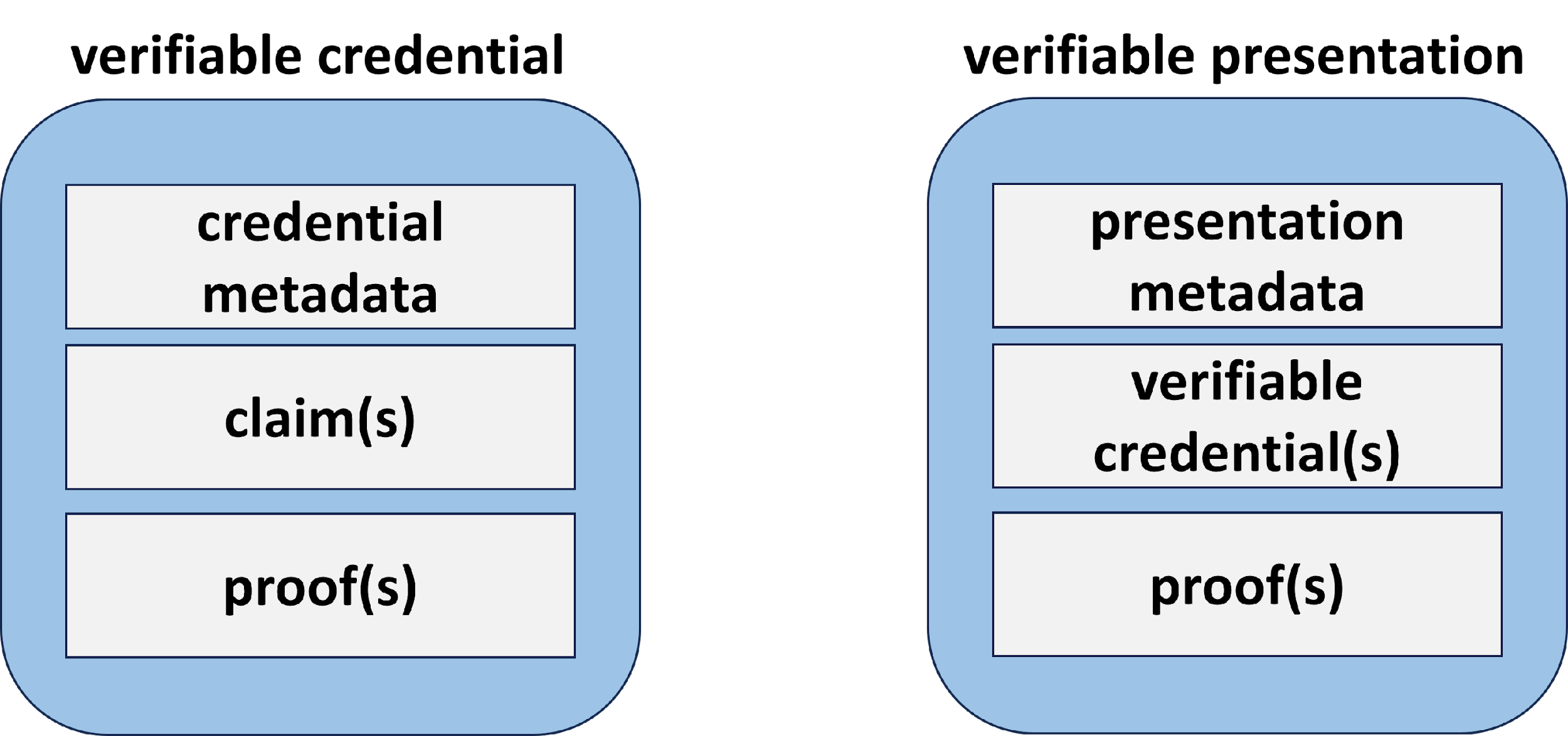

A VC consists of metadata, one or more validated claims,

and the Credential Issuer’s digital signature (see Figure 4). The digital signature makes the VC

tamper-evident and trustworthy but does not support confidentiality.

Although the authorship of a VC can be cryptographically

verified, there is no built-in guarantee that the claims contained within the

VC are valid or accurate. The Verifier trusts the Credential Issuer to perform

sufficient due diligence to make the claims “fit for purpose” as represented by

a VC Assurance Level (see Section 2.6).

Similarly, a

Verifiable Presentation consists of metadata, one or

more VCs, and the Holder’s digital signature (see Figure 4). The signatures

in the VP certify that both the Credential Issuer and the Credential Holder are

vouching for the claims.

Figure

4: Structure of a VC and a VP

The Holder consents to the inclusion in the VP of one or

more VCs that they possess or can acquire. The Verifier receives the VP and

performs verification functions that are based on rules defined by the Service

Provider. A VP is verifiable when

it:

-

is signed and presented by

the expected Holder

-

conforms to a specific VC

schema or a presentation definition

-

includes the required

cryptographic signatures, and

-

meets the Service Provider’s

criteria for business acceptability and risk.

The JSON metadata

includes general characteristics of the information included in the VCs and VPs,

including but not limited to:

- credential identifier

- validity date

- time period

- Credential Issuer

- credential schema

- assurance level

- verification material

- revocation mechanism

Biometrics

refers to the identification and verification of individuals based on unique

physical or behavioral traits. Biometrics includes but is not limited to:

-

picture (basic or templated)

-

fingerprints

-

facial recognition

-

iris patterns

-

palm scan

-

voice recognition

-

behavioral (gait analysis, keystrokes)

-

liveness test

Fingerprints and

facial recognition are widely used for accessing smartphones and laptops.

Multiple biometric attributes can also be used for increased confidence in the

identification process.

A photograph

(e.g., a JPEG or GIF) can be interpreted as a form of biometric, although

picture files are often used for in-person visual verification than for

automated biometric matching.

Interoperability

data standards are essential for ensuring that different biometrics systems and

devices can work together seamlessly. Standards that help to achieve this goal

include:

-

ISO/IEC 19794 outlines the formats for the

interchange of biometric data including fingerprints, facial images, iris

images, and voice data.

-

ISO/IEC 30107 focuses on presentation attack

detection (PAD), ensuring that biometric systems can distinguish between

genuine biometric traits and artificial representations used to spoof the

system.

-

ANSI/NIST-ITL 1-2011 provides guidelines for the

exchange of biometric data and is commonly used by law enforcement agencies.

-

ICAO Doc 9303, developed by the International

Civil Aviation Organization, specifies the use of biometrics in travel

documents, such as e-passports, to facilitate international travel.

Biometric

systems employ the concept of “biometric templates” to generate a digital

representation of the individual's biometric data. The basic steps in the

process are:

a)

Data Capture: The

raw biometric data is captured by a sensor (e.g., fingerprint scanner, camera).

b)

Preprocessing:

The raw biometric data is processed to enhance quality and remove noise.

c)

Feature Extraction: Key features are extracted from the preprocessed data. For

example, this might include points such as ridge endings and bifurcations in a

fingerprint.

d)

Template Creation:

The extracted features are converted into a digital representation, thereby creating

the biometric template.

e)

Storage: The

template can be securely stored in a user-controlled database, in a Holder’s

wallet or in a device such as a smart card.

Biometric

templates can be incorporated into a VC as specialized claims and be linked to

the individual's digital identity to provide a strong form of authentication.

Biometric-specific metadata provides additional information such as the time

and location of capture, the quality of the biometric sample, and the device

used for capture. This metadata ensures the integrity and authenticity of the

biometric data and results in a higher level of security, as it is challenging

to forge both the biometric data and the associated metadata.

The Common

Biometric Exchange Formats Framework [CBEFF] provides a comprehensive

set of data elements (i.e., VC claims) used for biometric interoperability. Key

VC claims include:

-

Biometric Identifier: Numeric data elements used to identify biometric objects within

biometric data records.

-

Biometric Feature:

Defines the type of biometric data (e.g., fingerprint, face, voice).

-

Validity Period:

Specifies the time period during which the biometric data is valid.

-

Creator Field:

Identifies the product or entity that created the biometric data.

-

Index Field:

Associates a specific instance of biometric reference data.

-

Challenge-Response Field: Used for security purposes to verify the authenticity of the

biometric data.

-

Payload Field:

Contains the actual biometric data.

When required, a

Holder can present their biometric VC to a Verifier. The Verifier

cryptographically verifies the VC's authenticity and integrity to ensure the

biometric data matches the Subject’s real identity.

A Verifiable

Credential (VC) JSON Schema is a JSON-based format for describing the structure

of JSON data. The JSON Schema asserts what a JSON document must look like, ways

to extract information from it, and how to interact with it.

VCs are written

as JSON objects (see Figure 1), with their contents described by a JSON Schema.

Although the claim content required is dictated by the Service Provider, some

claims will be common to many credential types (e.g., the name of the Subject)

and are widely used.

Schemas facilitate interoperability by defining the

structure of the VC. The W3C Verifiable Credentials JSON Schema Specification

[W3C JS] is a standard for VC schemas that can be used to ensure maximum

compatibility.

Two types of schema are of particular interest: (a) data verification schemas

for verifying that the structure

and contents of a credential or verifiable credential conform to a published

schema, and (b) a data encoding schema that maps the contents of

a VC to alternative representation formats, such as a format used in a

zero-knowledge proof.

A VP schema is a composition of the schemas for each of the

VCs that are included in the VP.

In a Decentralized

Identity Ecosystem, one goal is to separate the processes for determining

details about the Subject (i.e., the actual or prospective customer) from those

for delivering some or all of the information to a Service Provider (i.e., a

seller who wants to know the customer).

Standardized VC/VP

schemas can benefit participants in the Decentralized Identity Ecosystem by

providing:

-

well-known and well-accepted

specifications for the VCs that the Credential Issuer generates, thereby enhancing

consistency and completeness.

-

a means to pre-define information

that the Verifier needs, thereby increasing efficiency for high-volume SP transactions.

-

a simplification in how VCs can

be transformed into VPs, thereby reducing reliance on the Holder application.

-

a reduction in “friction”

associated with collecting, proofing, notarizing, consenting and presenting

information to the Service Provider.

For some use cases,

a simplified “lightweight” VC is sufficient. A VC can be considered lightweight

if it:

-

is formatted

as a JSON Web Token (JWT),

optionally with selective disclosure,

-

adopts IANA reserved names

to the maximum extent possible,

-

excludes arrays and optional

claims,

-

accepts VC Assurance Levels as

stated by the Credential Issuer, and

-

does not require trusted

processing in the Holder’s Wallet.

The functions and processes associated with VC schemas continue to

evolve as the standards and technologies for Decentralized Identity Ecosystems mature.

An Assurance Level

is a “level of confidence in the binding between an entity and the presented

identity information” [ITUT1252].

VC Assurance

Levels represent a statement of the robustness of the Credential Issuer’s claim

validation processes. It can include the level of confidence in the Subject

making the VC claims, the Credential Issuer that examines the evidence concerning

the VC claims, and the credibility of the VC itself.

NIST [NIST SP800] has defined the following categories of Assurance

Level:

-

Issuer Assurance Level (IAL)

– the trust rating of the Credential Issuer at a specific point in time;

provides a measure of the reputation of the Credential Issuer;

-

User Assurance Level (UAL) –

the trust rating of the User at the time of the issuance of a VC; provides a

measure of the reputation of the End User;

-

Credential Assurance Level

(VC-AL) – a trust rating that indicates the diligence used in vetting and

proofing the claims contained in the credential.

Assurance Levels for the Credential Issuer and the

Credential Holder are not included in a VC schema but can be the subject of

external processes.

The VC metadata

should include a property stating the VC Assurance Level that is aligned with NIST SP 800-63-A. The standard Assurance

Levels for a VC are:

-

VC-AL1 which has a low confidence level – claims

in the VC are treated as untested (e.g., they may be self-attested without provable

evidence)

-

VC-AL2 which has a high confidence level –

claims in the VC are validated through remote or in-person proofing processes with

inspection of key claim evidence

-

VC-AL3 which has a very high confidence level –

claims in the VC are validated through in-person proofing processes with verified

evidence for all claims

These Assurance Levels are intended to provide minimum

guidance only. Credential Issuers are not restricted as to how, when or where

to prove the claims presented by a Subject.

VC schemas should

also support the OpenID Identity Connect for Identity Assurance 1.0 [OID-IA] and OpenID Identity Assurance

schema definition 1.0 [OID-IAS].

The Service Provider is not required to make business

decisions based only on the VC Assurance Levels. For any specific context, however,

policies to govern the use and interpretation of VC Assurance Levels should be

defined.

This section is

informative.

Note: In KYC

systems a “customer” is equivalent to a “Subject” in a Digital Identity Ecosystem.

The phrase “Know

Your Customer” (KYC) can be defined as vetting a person to whom products or services may be offered to:

- confirm their identity to a desired level of

certainty; and

- evaluate the legal, regulatory and financial

risks associated with the transaction.

For example, KYC,

when used by financial services organizations, helps to verify that the

customer intends to use their account only for legal purposes (i.e., not for

money laundering).

In today’s world

of deep fakes, phishing and identity theft, KYC can support a wide range of

customer-supplier interactions including but not limited to:

- setting up an online shopping cart;

- filling a medical prescription at a pharmacy;

- subscribing to an age-restricted social network;

- subscribing to an online newspaper; or

- obtaining a university transcript.

Although

collecting and retaining KYC information is not always legally required, it can

still be useful for various business purposes including assuring safety, promoting

efficiency and improvement of customer experience. For example, customer

preferences, purchase history and current context all provide valuable insights

for marketing and product management.

KYC aims to

increase accountability at all stages of the identification process:

- The Credential Issuer generates a valid VC with

an acceptable level of assurance in both the evidence and the validation

process.

- The KYC VC schema includes the structure,

contents and metadata needed to facilitate verifiability and to increase trust

in the Credential Issuer.

- The customer (Subject/Holder) has control over

the VCs for which they are the subject and can determine who is allowed to have

access to the claims.

- The supplier is able to dictate what it needs to

know about the prospective customer.

One general

caveat related to both physical and digital KYC is that “knowing too much”

about a customer often leads to security and privacy issues including

inappropriate use and retention of personal data.

Traditionally,

KYC was based on physical, in-person inspection of trustworthy documents (e.g.,

a driver’s license or a birth certificate). Opening a bank account, for

example, would involve a meeting with a bank manager to take a copy of

reference documents for use as evidence. Paper documents and “signature cards” were

held by the bank branch for cheque verification.

Online KYC, often

referred to as “eKYC”, represents the digital transformation of KYC processes

to allow online presentation of identity credentials. eKYC requirements can vary

widely depending on the needs of the Service Provider. Credential sources

range from online inspection of remote evidence to full in-person data capture.

Justification for claim requirements include business policies, operational constraints,

jurisdictional considerations, and potential legal or regulatory restrictions.

The spectrum of transaction requirements ranges from almost nothing (e.g., simply

a proof of age) to an extensive investigation into the Subject’s identity and intentions.

eKYC processes

and data collection should be tailored to fit the particular use case, with the

goal being to collect just enough information to allow the supplier to meet their

legal requirements and to make a risk-based decision on accepting a customer

request.

Within the

Decentralized Identity Ecosystem, eKYC is an interaction between the Service

Provider and the Subject – the Service Provider defines a Verifiable

Presentation definition that encompasses what they need in order to provide

goods or services. The eKYC requirement can vary widely but will likely be

well-defined and consistent within a sector.

For example, for

an alcohol retailer KYC might require age verification only while a bank would

need full legal name, address, proof of residency, and a credit rating. In some

cases, knowing your customer could involve explicit investigation of evidence to

detect forgeries, etc.

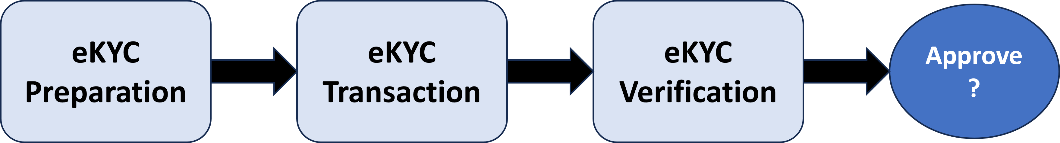

In Figure 5

illustrates the stages in a basic eKYC process that incorporates Verifiable

Credentials:

Figure

5: Stages in an eKYC Process

The Service

Provider determines the information

needed for the transaction and the acceptable assurance levels for the

credential and the issuer. eKYC information varies widely – from the most basic

Zero Knowledge Proof of age to much more complex biometrics processing and

evidence capture. For example, facial recognition systems can compare a face to

a basic photograph or to a real-time image with liveness detection.

The Issuer Assurance Level, which is not usually contained directly

in the eKYC VC, allows Credential Issuers to be evaluated as credible sources

of eKYC information.

The Service Provider selects a standard eKYC VC schema

(such as one of the Templates defined in Section 5). If necessary, the Service

Provider can define and publish a custom eKYC schema. The Service Provider can

also request additional information that goes beyond the scope of eKYC.

The VC schema is also used to establish policies and

decision criteria for the Verifier, which could include data retention and legal

reporting rules.

The Service Provider requests the prospective customer (the

Holder/Subject) to submit an eKYC VC that conforms to the chosen VC schema. A basic

identity might include a photo, a scanned evidence document or a zero knowledge

proof.

The Holder either has possession of the required claim information

or has access to a Credential Issuer who can generate it.

The Holder consents to submit the eKYC VC using data from a

wallet or cloud vault and submits a Verifiable Presentation to the Verifier.

The Verifier can be a Service Provider role or a 3rd party acting as

a proxy.

Adoption of a standard eKYC VC schema that matches

the SP requirements would eliminate unnecessary information, especially

personal information, and processing. This minimizes the overhead associated

with preparing and delivering a Verifiable Presentation.

The Verifier service receives and checks the VP against

the VC schema(s). This includes checking the format and cryptographic

signatures and also assessing both the VC Assurance Level and the reputation of

the Credential Issuer. The Verifier then provides the verification results to

the SP for their business decision.

The Service Provider decides whether or not to

accept the prospective customer based on the verification results.

The Service Provider can also compare extracted

data to other trusted data sources and watchlists to evaluate the risk and

check for any red flags.

This section is informative.

A JSON Schema is

an agreement on the syntax, semantics, context and security of the information that

is to be shared digitally between a consumer (requestor) and a supplier

(provider).

Service

Providers requiring eKYC information for their internal business processes can

choose between a standard VC schema as defined in this standard or a custom VC

developed themselves, by a Credential Issuer, or by a third party.

A basic eKYC VC

can also be enhanced if the SP requests other VCs also be supplied. As an

example, a standard eKYC VC provided by a Credential Issuer might include a

birth date that has not been proven with evidence and may not include criminal

convictions. To mitigate this deficiency, the SP could also request a birth

certificate and police record issued by highly-trusted government agencies.

Credentials for eKYC

should include claims that:

- describe the person sufficiently to answer the

question – Who is this person?

- provide statements that help to answer the

question – Is this person acceptable as a customer?

- provide other predefined information to answer

questions such as – What jurisdiction is the customer in?

There are many

reasons why a Service Provider (i.e., suppliers – anyone who has customers)

needs to collect information about their customers, but it is not an “all or

nothing” choice. Some interactions just need a proof of age (or even just

humanity), others need basic contact data, while still others involve extensive

descriptions of a person’s skills and experience in addition to personal

characteristics (such as a resume).

Some day-to-day

interactions (both in person and electronic) can be anonymous with no

requirement for a verified name. Examples include:

- attendance at a public event (need only age

verification);

- completing polls and surveys (require just a

location); and

- reserving a restaurant table (only requires a

callback number).

Financial institutions, on the other hand, must

use reasonable diligence to identify and retain the true identity of every

customer and every person acting on behalf of those customers. Information

for enforcing full financial eKYC can include:

1.

Customer name, date of

birth, address, and a government document number;

2.

Customer due diligence,

which verifies the identity of customers associated with open accounts. The core requirements are:

- identify the customer and verify the identity,

with ongoing monitoring for suspicious transactions;

- identify and verify the identity of beneficial

owners of companies opening accounts;

- understand the nature and purpose of customer

relationships to develop customer risk profiles.

3.

Enhanced due diligence is

required when high-risk factors have been identified. The information collected

includes a source of wealth and funds check; additional identity research; and risk identification and

assessment.

Multiple use

cases have been targeted by the European eIDAS 2.0 and EUDI wallet developers [EUDI] including but not limited

to:

- Access to government services;

- Opening a bank account;

- Registering for a SIM card;

- Mobile driving licenses;

- eSignatures;

- ePrescriptions;

- Payment authorization by the wallet user;

- Storage and display of digital travel

credentials; and

- Digital education and social security

credentials.

In all of these

cases, basic information about the requestor (i.e., the customer) is necessary

before a transaction can be completed. The wallet lets citizens and businesses

digitally identify themselves simply by using their smartphones. People control

their wallet and personal data and only share what they want with whom they

want.

eKYC decisions

are not a simple yes/no based on whatever information happens to be presented.

One or more sources may be required to deliver the information needed by the

Service Provider. Examples of information that may be needed includes but is

not limited to:

- Basic identification – what is my name?

- Personal description – how old am I? What do I

look like? What are my distinguishing features (e.g. eye color)?

- Government documents – birth certificate, driver’s

license, marriage certificate, health card

- Situation – where am I located currently? Where

do I live? Where was I born?

- Relationships – family members? associates?

marital status?

- Memberships – what groups or societies do I

belong to?

- Occupation – where do I work? What job do I have?

- Certificates – what licenses and certifications

do I have? What degrees or diplomas do I have?

- Capabilities – what are my skills and training?

- Experiences – what have I done in the past?

major accomplishments?

- Publications – books, articles, social posts,

etc.

- Awards – prizes, recognitions, winnings

- Reputation – formal and informal rankings

There are three

considerations when making eKYC information requests:

a)

Claim suitability – These

are the “attributes” of the customer that the Service Provider is asking to be

provided. The request should be limited to what is really needed for the

transaction and not include data that is not relevant. For example, an

electronic driver’s license would not need to include family members.

b)

Assurance levels – Each

Claim can be evaluated based on how well it has been tested for validity. At

the lowest level, the Subject simply states that the Claim is authentic. eKYC

processes aim to ensure that Claims are issued from a trusted source and can be

validated.

c)

Personal privacy – Service

Providers should only request Claims that they need and should minimize the

need to store PII. The Customer (i.e., the Holder) should also consent to the

disclosure of information that they feel is warranted for the transaction.

There are currently only a few standardized

formats for releasing electronic attestations of Claims:

- ISO/IEC

18013-5 defines an attribute schema, data format and proof mechanisms for

mDL-s, which can be used also with other attribute schemas, see [ISO/IEC

18013-5].

- Selective

Disclosure for JWTs (SD-JWT) defines a proof mechanism similar to [ISO/IEC

18013-5], but for a different data format, see [SD-JWT].

- W3C Verifiable

Credentials Data Model – see [W3C

VCDM2].

This section is

informative.

Figure 6 is a

simple example of a JSON-JWT that delivers an email address. Part 1 is the JWT

and Part 2 is the corresponding JsonSchema as referenced by Part 1. In this

example, the only claim is an email address written in the standard internet

format.

|

Part 1 - Email Credential referencing a JsonSchema

{

"@context": [

"https://www.w3.org/ns/credentials/v2",

"https://www.w3.org/ns/credentials/examples/v2"

],

"id": "https://example.com/credentials/3732",

"type": ["VerifiableCredential",

"EmailCredential"],

"issuer": "https://example.com/issuers/14",

"issuanceDate": "2010-01-01T19:23:24Z",

"credentialSubject": {

"id": "did:example:ebfeb1f712ebc6f1c276e12ec21",

"emailAddress": "subject@example.com"

},

"credentialSchema": {

"id": "https://example.com/schemas/email.json",

"type": "JsonSchema"

}

}

|

|

Part 2 - JSON Schema for the Email Credential

{

"$id": "https://example.com/schemas/email.json",

"$schema": "https://json-schema.org/draft/2020-12/schema",

"title": "EmailCredential",

"description": "EmailCredential using JsonSchema",

"type": "object",

"properties": {

"credentialSubject": {

"type": "object",

"properties": {

"emailAddress": {

"type": "string",

"format": "email"

}

},

"required": [

"emailAddress"

]

}

}

}

|

Source: [W3C VCJS] Section 2.1

Figure 6: Example of a JSON-JWT with a

JSON Schema

The templates defined

in sections 5.2 to 5.6 are similar to the example, with the number and variety

of claims designed to fit the specific use cases. The goal is to have a set of schemas

that cover common use cases on which the Credential Issuer, the Service

Provider and the Holder can jointly agree.

The templates as

defined in this document only include Claims that are required, not all

possible claims. It is anticipated that the templates will be extended or

modified over time.

The claims and

examples provided in this document are based on the JasonSchema type which uses

JSON schema documents. Schemas may also be packaged as Verifiable Credentials.

For the

templates defined in sections 5.2 to 5.6, see [OIDC} and [IANA] for standard

definitions of the claims.

There are many

situations when very basic customer information needs to be provided to allow a

service provider to provide good customer service on an ongoing basis. This can

be thought of as the equivalent of a “business card” for an individual.

Examples of this scenario would include:

- A person meets a salesperson and wishes to

provide just enough information to arrange a future meeting. The salesperson

wants basic confirmation that the name and contact are correct.

- A person subscribes to a physical magazine or

newsletter. The publisher wants to verify the name and postal address to avoid mis-deliveries.

The goal of

Template 1 is to demonstrate that:

- the customer is a human (i.e., proof of

personhood);

- the name provided has been verified to be the

person;

- the contact information provided is correct and

matches the person at a given point in time.

Template 1

Claims are typically public information and would not be subject to privacy

restrictions related to storage or use. The Credential Issuer checks that the

person is in fact a real human and validates the Claims by inspection of

evidence.

Template 1

provides a schema for a simple JWT credential using IANA-registered claims and

has no options or selective disclosure capabilities. Table 4 provides the claim

details for Template 1 (See Appendix E for the full IANA listing).

|

Template 1

|

|

Claim/Attribute

|

Type

|

Source

|

Brief Description

|

|

given_name

|

string

|

IANA

|

Usual first name of the Subject

|

|

family_name

|

string

|

IANA

|

Usual last name of the Subject

|

|

phone_number

|

string

|

IANA

|

Preferred telephone number including

country codes (E.164 format is recommended)

|

|

email

|

string

|

IANA

|

Preferred email address (RFC 5322

address)

|

|

address

|

JSON

object

|

IANA

|

Preferred postal address (Note 1)

|

|

Claims common to all Templates

|

|

sub

|

string

|

IANA

|

Subject – Identifier for the End-User at

the Issuer

|

|

issuer

|

string

|

|

Party that issued the VC

|

|

assurance_type

|

string

|

|

Assurance standard (e.g. NIST SP 800-63.3)

(Note 2)

|

|

assurance_level

|

string

|

|

VC-AL1, VC-AL2, VC-AL3

|

|

assurance_evidence

|

string

|

|

URL for evidence relating to the VC

assurance level

|

|

updated_at

|

number

|

IANA

|

Time of last update

|

Table

1: Basic Personal Identity VC Schema

Note 1: The address claim in Table 1 represents a physical mailing address

and is a JSON structure containing

some or all of the following represented as JSON

strings:

-

formatted: Full

mailing address, formatted for display or use on a mailing label. This field

MAY contain multiple lines, separated by newlines. Newlines can be represented

either as a carriage return/line feed pair ("\r\n") or as a single

line feed character ("\n").

-

street_address: Full

street address component, which MAY include house number, street name, Post

Office Box, and multi-line extended street address information. This field MAY

contain multiple lines, separated by newlines. Newlines can be represented

either as a carriage return/line feed pair ("\r\n") or as a single

line feed character ("\n").

-

locality: City or

locality component.

-

region: State,

province, prefecture, or region component.

-

postal_code: Zip

code or postal code component.

-

country: Country

name component.

Note 2: The assurance

claims in Table 1 is a representation of the strength of identity proofing that

was completed by the Credential Issuer in generating the VC. The following assurance

levels are based on the IAL definitions contained in [NIST800]:

-

VC-AL1: claims, if any, are self-asserted or

should be treated as self-asserted.

-

VC-AL2: claims, if any, require either remote or

in-person identity proofing; verifying procedures are specified in [NIST800]

-

VC-AL3: claims, if any, require in-person

proofing that is verified by an authorized representative through examination of

physical documentation.

In some

situations, the primary concern is whether the customer is over a specific age,

such as 19 or 21. It is not necessarily important to know the actual date of

birth or gender, but these could be options. The service provider may also want

to be able to verify that the customer is presenting the correct credentials

(by examining a photograph).

Examples of this

scenario would include:

- A person attempts to buy restricted items at a

retail outlet (e.g., cigarettes or alcohol). The salesperson requires basic

confirmation that the customer is of legal age and hasn’t “borrowed” another

person’s wallet.

- A person wants access to a bar or club. The door

person needs to validate a photo of the person and be sure the person is in the

correct age range.

In essence, the

goal of Template 2 is to demonstrate that:

- the presenter of the credential is a human

(i.e., proof of personhood);

- the presenter is the subject of the claims;

- the age claims are correct and matches the

person at a given point in time.

Note that the

minimum requirement is a name and “greater than” age from a trusted Credential

Issuer. All other claims can be selectively consented by the Holder. Template 2

is a superset of Template 1.

Template 2

provides a schema for a SD-JWT VC using IANA-registered claims and has

selective disclosure capabilities. Table 5 provides the claim details for

Template 2 (See Appendix E for the full IANA listing).

|

Template 2

|

|

Claim/Attribute

|

Type

|

Source

|

Description

|

|

given_name

|

string

|

IANA

|

Usual first name of the Subject

|

|

family_name

|

string

|

IANA

|

Usual last name of the Subject

|

|

picture

|

string

|

IANA

|

URL of the Subject’s profile picture

pointing to an image file

|

|

gender

|

string

|

IANA

|

Gender of the Subject, including male,

female and others

|

|

birthdate

|

string

|

IANA

|

Birthdate of the Subject in ISO 8601-1

format;

0000 to indicate omitted

|

|

is_over_18

|

boolean

|

|

True if over 18; otherwise, false

|

|

is_over_21

|

boolean

|

|

True if over 21; otherwise, false

|

|

is_over_65

|

boolean

|

|

True if over 65; otherwise, false

|

|

is_over_13_and_less_ than_18

|

boolean

|

|

True if between 14 and 17; otherwise,

false

|

|

|

|

|

|

|

sub

|

string

|

IANA

|

Subject identifier

|

|

issuer

|

string

|

|

Party that issued the VC

|

|

assurance_type

|

string

|

|

Assurance standard (e.g. NIST SP

800-63.3)

|

|

assurance_level

|

string

|

|

VC-AL1, VC-AL2, VC-AL3

|

|

assurance_evidence

|

string

|

|

URL for evidence relating to the VC

assurance level

|

|

updated_at

|

number

|

IANA

|

Time of last update

|

Table

2: Basic Age Disclosure Schema

As noted in

Section 4.2, financial institutions must use reasonable due diligence to determine

and retain the identity of every customer and every

person acting on behalf of those customers. Information required for

enforcing KYC regulations can vary by jurisdiction but typically includes

customer name, date of birth, address, and an Identification Number.

Examples of

situations where financial KYC could be applied include:

- Opening a bank account as a new customer;

- Applying for loans and other credit products;

and

- Transferring large amounts of money especially

across borders.

Financial KYC requirements

will vary by jurisdiction and also by the risk management policies of the

institutions. Enhanced due diligence requirements may be required for

suspicious transactions, company ownership questions, and generally for

developing customer risk profiles.

In the USA, Section 326 of the Patriot Act requires banks and other financial institutions to

have a Customer Identification

Program (CIP). Financial

institutions must collect four pieces of identifying information about their

customers including:

- Name

- Date of Birth

- Address

- Identification Number

Template 3

provides a schema for a simple JWT credential using IANA-registered claims and

has no options or selective disclosure capabilities. Table 6.1 below provides

the claim details for Template 3.

|

Template 3

|

|

Claim/Attribute

|

Type

|

Source

|

Description

|

|

given_name

|

string

|

IANA

|

Usual first name of the Subject

|

|

middle_name

|

string

|

IANA

|

Middle name of the Subject

|

|

family_name

|

string

|

IANA

|

Usual last name of the Subject

|

|

phone_number

|

string

|

IANA

|

Preferred telephone number including

country codes (E.164 format is recommended)

|

|

email

|

string

|

IANA

|

Preferred email address (RFC 5322

address)

|

|

address

|

JSON

object

|

IANA

|

Preferred postal address (JSON RFC 8259

structure)

|

|

ID_reference_type

|

string

|

IANA

|

Type of ID document (SSN, Resident ID,

Aadhaar ID, etc.)

|

|

ID_reference

|

string

|

IANA

|

Government-issued number

|

|

|

|

|

|

|

sub

|

string

|

IANA

|

Subject identifier

|

|

issuer

|

string

|

|

Party that issued the VC

|

|

assurance_type

|

string

|

|

Assurance standard (e.g. NIST SP 800-63.3)

(Note 2)

|

|

assurance_level

|

string

|

|

VC-AL1, VC-AL2 or VC-AL3

|

|

assurance_evidence

|

string

|

|

URL for evidence relating to the VC

assurance level

|

|

updated_at

|

number

|

IANA

|

Time of last update

|

Table

3: Financial Customer Schema

A biometric VC can be used as a proof of

personhood and would replace methods of testing for humanity such as CAPTCHA.

Interoperable biometrics require a set of

standardized data elements to ensure seamless data exchange between different

systems and components. The Common Biometric Exchange Formats Framework [CBEFF] provides a comprehensive

set of these data elements. Here are some key elements:

- Biometric Identifier:

Numeric data elements used to identify biometric objects within biometric

data records.

- Biometric Feature:

Defines the type of biometric data (e.g., fingerprint, face, voice).

- Validity Period:

Specifies the time period during which the biometric data is valid.

- Creator Field:

Identifies the product or entity that created the biometric data.

- Index Field:

Associates a specific instance of biometric reference data.

- Challenge-Response Field: Used for security purposes to verify the authenticity of the

biometric data.

- Payload Field:

Contains the actual biometric data.

Common Biometric Exchange Formats

Framework

·

ISO/IEC 19785-1:2020

·

NIST IR 6529A (2004)

|

Template 4

|

|

Claim/Attribute

|

Type

|

Source

|

Description

|

|

given_name

|

string

|

IANA

|

Usual first name of the Subject

|

|

family_name

|

string

|

IANA

|

Usual last name of the Subject

|

|

picture

|

string

|

IANA

|

URL of the Subject’s profile picture

pointing to an image file

|

|

biometric_method

|

string

|

|

Type of biometric

|

|

biometric_template

|

string

|

|

URL of the Subject’s biometric template.

This URL MUST refer to a biometric template (for example, a fingerprint),

rather than to a Web page containing a file. Note that this URL SHOULD

specifically reference a standards-based biometric template of the Subject

suitable for comparing to an in-person biometric.

|

|

validity_period

|

string

|

|

Specifies the time period during which

the biometric data is valid

|

|

Biometric_creator

|

string

|

|

Identifies the product or entity that

created the biometric data

|

|

|

|

|

|

|

sub

|

string

|

IANA

|

Subject identifier

|

|

issuer

|

string

|

|

Party that issued the VC

|

|

assurance_type

|

string

|

|

Assurance standard (e.g. NIST SP

800-63.3) (Note 2)

|

|

assurance_level

|

string

|

|

VC-AL1, VC-AL2 or VC-AL3

|

|

Assurance_evidence

|

string

|

|

|

|

updated_at

|

number

|

IANA

|

Time of last update

|

Table

4: Basic Biometric VC Schema

There will be situations for which the

Service Provider wants or needs to gather a more complete customer profile.

This could be useful for enhanced customer relationship management or to ensure

variations in a customer description can be detected.

Table 5 provides a more extensive list of

claims taken from the IANA list (extracted as of October 2024).

|

Claim/Attribute

|

Type

|

|

Description

|

|

sub

|

string

|

IANA

|

Subject - Identifier for the End-User at

the Issuer.

|

|

name

|

string

|

IANA

|

End-User's full name in displayable form

including all name parts, possibly including titles and suffixes, ordered

according to the End-User's locale and preferences.

|

|

given_name

|

string

|

IANA

|

Given name(s) or first name(s) of the

End-User.

|

|

family_name

|

string

|

IANA

|

Surname(s) or last name(s) of the

End-User.

|

|

middle_name

|

string

|

IANA

|

Middle name(s) of the End-User.

|

|

nickname

|

string

|

IANA

|

Casual name of the End-User that may or

may not be the same as the given_name. For instance, a nickname value of Mike

might be returned alongside a given_name value of Michael

|

|

preferred_username

|

string

|

IANA

|

Shorthand name by which the End-User

wishes to be referred to at the RP, such as janedoe or j.doe. This value MAY

be any valid JSON string including special characters such as @, /, or

whitespace. The RP MUST NOT rely upon this value being unique.

|

|

profile

|

string

|

IANA

|

URL of the End-User's profile page. The

contents of this Web page SHOULD be about the End-User.

|

|

picture

|

string

|

IANA

|

URL of the End-User's profile picture.

This URL MUST refer to an image file (for example, a PNG, JPEG, or GIF image

file), rather than to a Web page containing an image. Note that this URL

SHOULD specifically reference a profile photo of the End-User suitable for

displaying when describing the End-User, rather than an arbitrary photo taken

by the End-User.

|

|

website

|

string

|

IANA

|

URL of the End-User's Web page or blog.

This Web page SHOULD contain information published by the End-User or an

organization that the End-User is affiliated with.

|

|

email

|

string

|

IANA

|

End-User's preferred email address. Its

value MUST conform to the RFC 5322 addr-spec syntax. The RP MUST NOT rely

upon this value being unique.

|

|

email_verified

|

boolean

|

IANA

|

True if the End-User's email address has

been verified; otherwise, false. When this Claim Value is true, this means

that the OP took affirmative steps to ensure that this email address was

controlled by the End-User at the time the verification was performed. The

means by which an e-mail address is verified is context specific, and

dependent upon the trust framework or contractual agreements within which the

parties are operating.

|

|

gender

|

string

|

IANA

|

End-User's gender. Values defined by this

specification are female and male. Other values MAY be used when neither of

the defined values are applicable.

|

|

birthdate

|

string

|

IANA

|

End-User's birthday, represented as an

ISO8601-1 YYYY-MM-DD format. The year MAY be 0000, indicating that it is

omitted. To represent only the year, YYYY format is allowed. Note that

depending on the underlying platform's date related function, providing just

year can result in varying month and day, so the implementers need to take

this factor into account to correctly process the dates.

|

|

zoneinfo

|

string

|

IANA

|

String from IANA Time Zone Database

representing the End-User's time zone. For example, Europe/Paris or

America/Los_Angeles.

|

|

locale

|

string

|

IANA

|

End-User's locale, represented as an RFC

5646 language tag. This is typically an ISO 639 language code in lowercase

and an ISO 3166-1 country code in uppercase, separated by a dash. For

example, en-US or fr-CA. As a compatibility note, some implementations have

used an underscore as the separator rather than a dash, for example, en_US;

Relying Parties MAY choose to accept this locale syntax as well.

|

|

phone_number

|

string

|

IANA

|

End-User's preferred telephone number.

E.164 is RECOMMENDED as the format of this Claim, for example, +1 (425)

555-1212 or +56 (2) 687 2400. If the phone number contains an extension, it

is RECOMMENDED that the extension be represented using the RFC 3966 extension

syntax, for example, +1 (604) 555-1234;ext=5678.

|

|

phone_number_verified

|

boolean

|

IANA

|

True if the End-User's phone number has

been verified; otherwise false. When this Claim Value is true, this means

that the OP took affirmative steps to ensure that this phone number was

controlled by the End-User at the time the verification was performed. The

means by which a phone number is verified is context specific, and dependent

upon the trust framework or contractual agreements within which the parties

are operating. When true, the phone_number Claim MUST be in E.164 format and

any extensions MUST be represented in RFC 3966 format.

|

|

address

|

JSON

object

|

IANA

|

End-User's preferred postal address. The

value of the address member is a JSON RFC 8259 structure.

|

|

updated_at

|

number

|

IANA

|

Time the End-User's information was last

updated. Its value is a JSON number representing the number of seconds from

1970-01- 01T00:00:00Z as measured in UTC until the date/time.

|

|

ID_reference_type

|

String

|

|

Type of ID document (SSN, Resident ID,

Aadhaar ID, etc.)

|

|

ID_reference

|

String

|

|

Government-issued number

|

|

|

|

|

|

|

assurance_level

|

String

|

|

VC-AL1, VC-AL2 or VC-AL3

|

|

assurance_evidence

|

string

|

|

|

|

updated_at

|

Number

|

IANA

|

Time of last update

|

Table

5: Expanded Personal Identity Schema

Conformance Clause 1:

Implementations

that conform to this standard MUST consume and produce documents that conform

to the W3C Variable Credentials JSON Schema Specification and the W3C Variable

Credentials Data Model v2.0 or later.

Conformance Clause 2:

An

implementation that conforms to this standard MUST include all the claims

specified in one of the templates in Section 5 of this document.

Specifically,

the following claims are required:

- Template 1 includes all of the claims listed in Table 1.

- Template 2 includes all of the claims listed in Table 2.

- Template 3 includes all of the claims listed in Table 3.

- Template 4 includes all of the claims listed in Table 4.

- Template 5 includes all of the claims listed in Table 5.

Conformance Clause 3:

A document that

conforms to this standard MUST be valid against the JSON Schema of the selected

template and formatted as an SD-JWT or a JWT.

This appendix contains the normative and

informative references that are used in this document.

While any hyperlinks included in this

appendix were valid at the time of publication, OASIS cannot guarantee their

long-term validity.

A.1 Normative

References

The following

documents are referenced in such a way that some or all of their content

constitutes requirements of this document.

[RFC 2119]

Key

words for use in RFCs to Indicate Requirement Levels, BCP 14, RFC 2119, DOI

10.17487/RFC2119, March 1997, <https://www.rfc-editor.org/info/rfc2119>

[RFC 8174]

Ambiguity

of Uppercase vs Lowercase in RFC 2119 Key Words, BCP 14, RFC 8174, DOI

10.17487/RFC8174, May 2017, <https://www.rfc-editor.org/info/rfc8174>

[IANA JWT]

JSON Web Token Claims, IANA, https://www.iana.org/assignments/jwt/jwt.xhtml

[OIDC]

OpenID

Connect Core 1.0 incorporating errata set 2, December 15, 2023

https://openid.net/specs/openid-connect-core-1_0.html

[NIST800-63]

Digital

Identity Guidelines, NIST Special Publication 800-63-3

https://pages.nist.gov/800-63-3/

[RFC7519]

JSON

Web Tokens (JWT), IETF 7519 May 2015

https://datatracker.ietf.org/doc/html/rfc7519

[RFC8259]

T. Bray, Ed., "The JavaScript Object

Notation (JSON) Data Interchange Format", RFC 8259, DOI 10.17487/RFC8259,

December 2017, <https://www.rfc-editor.org/info/rfc8259>.

[W3C VCJS]

Verifiable

Credentials JSON Schema Specification – JSON Schema for Verifiable Credentials

– W3C Candidate Recommendation Draft 12 September 2024,

https://www.w3.org/TR/vc-json-schema/

[W3C

VC DM2]

W3C

Verifiable Credentials Data Model v2.0 – W3C Candidate Recommendation Draft, 26

January 2025,

https://www.w3.org/TR/vc-data-model-2.0/

[SD-JWT]

SD-JWT-based

Verifiable Credentials (SD-JWT VC), draft-ietf-oauth-sd-jwt-vc-08

https://datatracker.ietf.org/doc/draft-ietf-oauth-sd-jwt-vc/

A.2 Informative

References

The following referenced documents are not

required for the application of this document but may assist the reader with

regard to a particular subject area.

[EUDI]

The many use cases of EU Digital

Identity Wallets

https://ec.europa.eu/digital-building-blocks/sites/display/EUDIGITALIDENTITYWALLET/The+many+use+cases+of+the+EU+Digital+Identity+Wallet

[RFC3552]

Rescorla, E.

and B. Korver, "Guidelines for Writing RFC Text on Security

Considerations", BCP 72, RFC 3552, DOI 10.17487/RFC3552, July 2003,

https://www.rfc-editor.org/info/rfc3552

[ITUT1252]

Series

X: Data Networks, Open system Communications and Security – Baseline identity

management terms and definitions ITU-T X.1252

https://www.itu.int/rec/T-REC-X.1252-202104-I

[ITUT1254]

Series

X: Data Networks, Open system Communications and Security – Entity

authentication assurance framework ITU-T X.1254

https://www.itu.int/rec/T-REC-X.1254-202009-I/en

[OID-IA]

OpenID

Connect for Identity Assurance 1.0, October 1, 2024

https://openid.net/specs/openid-connect-4-identity-assurance-1_0.html

[OID-IAS]

OpenID

Identity Assurance Schema Definition 1.0, October 1, 2024

https://openid.net/specs/openid-ida-verified-claims-1_0-final.html

[OID-VCI]

OpenID

for Verifiable Credential Issuance - draft 15, December 19, 2024

https://openid.net/specs/openid-4-verifiable-credential-issuance-1_0.html

[GFMCMARK]

GitHub's fork of cmark, a CommonMark

parsing and rendering library and program in C,

https://github.com/github/cmark

[GFMENG]

GitHub Engineering: A formal spec for

GitHub Flavored Markdown,

https://githubengineering.com/a-formal-spec-for-github-markdown/

[ISO/IEC 18013-5]

Personal identification — ISO-compliant

driving licence Part 5: Mobile driving licence (mDL) application

https://www.iso.org/standard/69084.html

[CBEFF]

ISO/IEC 19785-1:2020 - Information

technology — Common Biometric Exchange Formats Framework

https://www.iso.org/standard/77892.html

Verifiable

credential (VC) documents are based on JSON, thus the security considerations

of [RFC8259] apply and are repeated here as service for the reader:

Generally, there

are security issues with scripting languages. JSON is a subset of

JavaScript but excludes assignment and invocation.

Since JSON's

syntax is borrowed from JavaScript, it is possible to use that language's